SoFi Falls Below $25: A Long-Term Buy or Watchlist Entry?

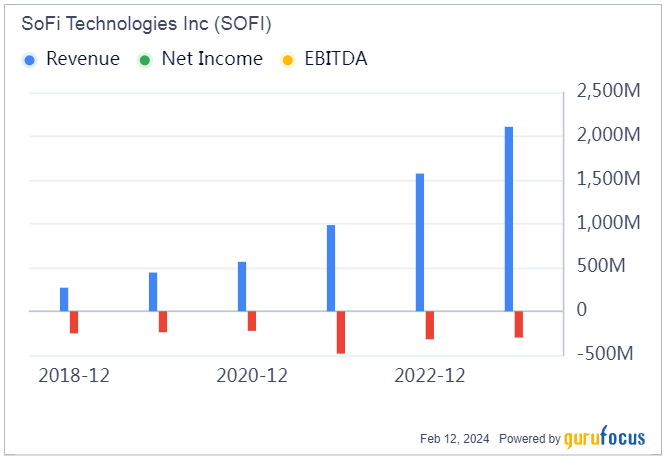

SoFi Technologies slid to about $22 after dipping below $25, even as the fintech lender reports robust growth, 12.6 million members, and a Q3 with record revenue ($950M) and eight straight quarters of profitability. Its strong position is aided by AI tools like Cash Coach, but the stock still trades at a high forward P/E (~44.8), suggesting it may not be cheap for quick profits. Long-term investors with higher risk tolerance might view this as a buying opportunity, while short-term traders may prefer to wait or watch for a lower entry.