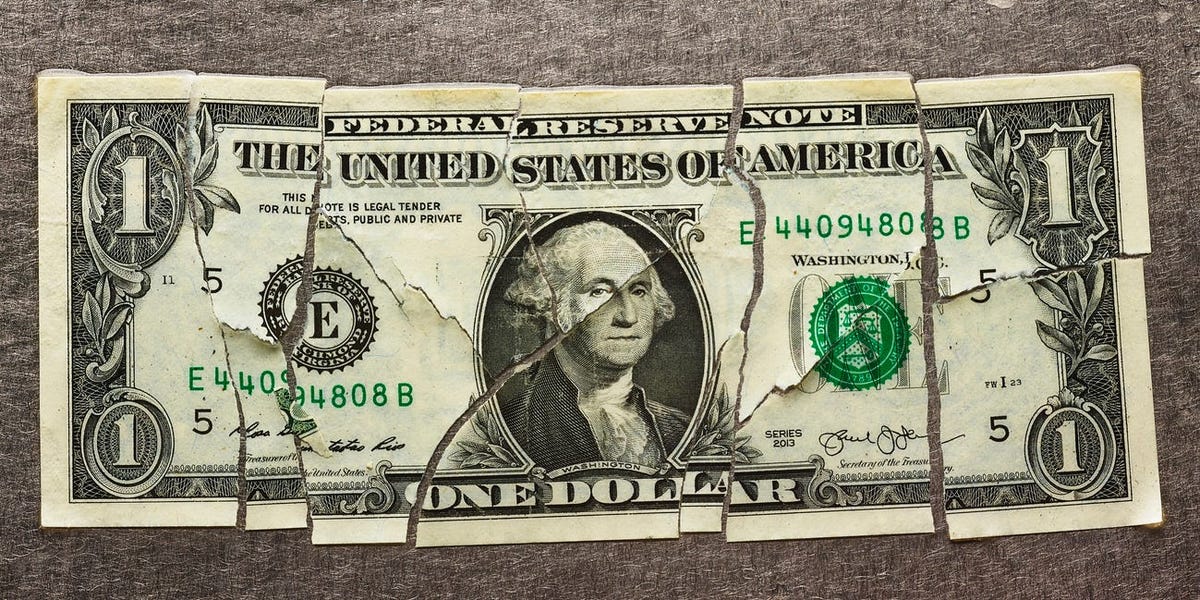

"Financial Markets: Are Data Swings Distorting Reality?"

Declining response rates in federal surveys measuring economic data, such as prices and job openings, are raising concerns for financial markets that heavily rely on this information to anticipate Federal Reserve policy. Former Fed economist Claudia Sahm warns that investors should exercise caution when reacting to official statistics, as the declining quality of surveys may lead to inaccurate estimates and increased market volatility. Falling response rates can increase uncertainty about the economy and result in larger-than-usual data revisions. While government statistics are still considered high quality, efforts are being made to expand sample sizes and reach out to more respondents to maintain data quality.