Regional Markets

All articles tagged with #regional markets

Asian Markets Mixed as Investors Await Fed Decision

Asian stocks were mixed ahead of the U.S. Federal Reserve's policy decision, with Japanese stocks near record highs after trade data showed a smaller-than-expected deficit, while markets await clues on future easing from the Fed's updated projections.

Asian Markets Rise Amid US Payrolls and Tech Rally

Most Asian stocks rose as investors awaited US nonfarm payrolls data, with Japan leading gains on trade optimism following a US-Japan trade deal and positive economic data, while Chinese markets steadied after recent losses and regional markets showed mixed performance amid global economic cues.

Navigating the Contrasting Housing Markets: Rising Prices, Declining Demand

The housing market in the United States is experiencing a divergence, with higher-end homes seeing price declines while starter homes remain relatively unaffected. This trend is driven by the increasing unaffordability of higher-priced homes, leading buyers to focus on smaller and lower-priced properties. Move-up buyers are also choosing to stay in their current homes, reducing demand in the upper price tier and decreasing supply in the lower price tier. Lower-priced homes have consistently outperformed higher-end homes, with many markets setting all-time highs for affordable housing options. This shift has also led to investors redirecting their focus to more affordable markets.

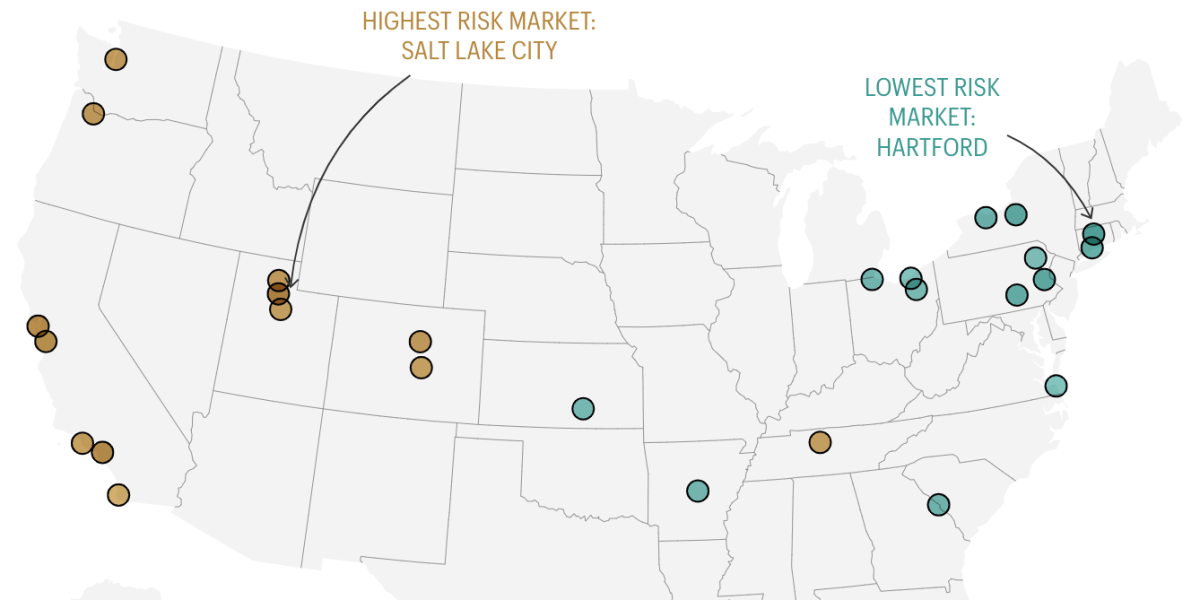

"Assessing Housing Market Risks: From Correction to Decline, Here's What to Expect"

Morningstar predicts a modest price correction in the national housing market, with house prices expected to be down between 4% to 6% from the peak by 2024. Factors supporting price resiliency include rate lock-in effect, conservative lending standards, and undersupplied housing stock. However, buyer exuberance during the pandemic and low borrowing costs pushed home prices to unsustainable levels in some markets. Morningstar identified the 15 housing markets with the highest correction risk, including San Diego, Austin, and Seattle, while the 15 markets with the lowest risk are predominantly in the eastern half of the country, such as Hartford and Syracuse.

Delta Airlines Continues to Suspend Services Across US Airports Due to Personnel Shortages.

Delta Air Lines will exit two regional markets, La Crosse, Wisconsin, and State College, Pennsylvania, effective June 5, bringing the total number of cities it has dropped during the pandemic to 17. The airline has not provided a timeline for when it might re-enter these markets. Delta is no longer selling any flights to either city beyond June 5. The pandemic and its effects have caused many major airlines to experience staffing shortages, particularly in their pilot ranks, leading to a major pullback in regional connectivity.