"Assessing Housing Market Risks: From Correction to Decline, Here's What to Expect"

TL;DR Summary

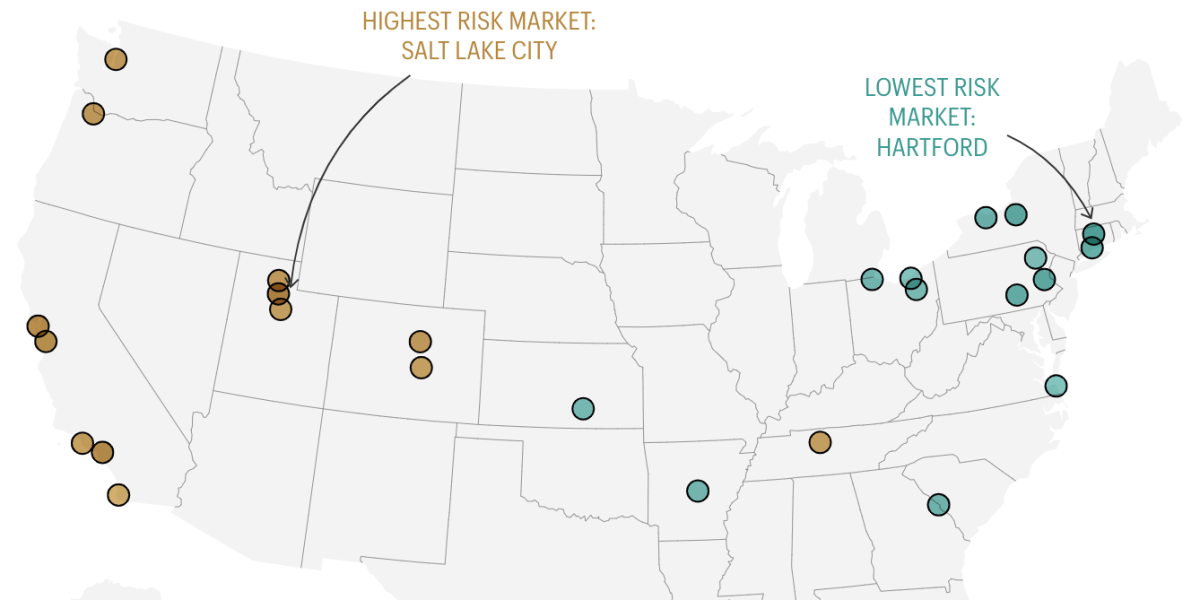

Morningstar predicts a modest price correction in the national housing market, with house prices expected to be down between 4% to 6% from the peak by 2024. Factors supporting price resiliency include rate lock-in effect, conservative lending standards, and undersupplied housing stock. However, buyer exuberance during the pandemic and low borrowing costs pushed home prices to unsustainable levels in some markets. Morningstar identified the 15 housing markets with the highest correction risk, including San Diego, Austin, and Seattle, while the 15 markets with the lowest risk are predominantly in the eastern half of the country, such as Hartford and Syracuse.

Topics:top-news#affordability#housing-market#price-correction#real-estate#regional-markets#risk-assessment

- Morningstar: 15 housing markets with the most correction risk—and the 15 with the least risk Fortune

- US home prices still face a 'steep and sustained' decline this year, economist warns Fox Business

- Homebuyers must 'learn to live' with near-7% mortgage rates, says RE/MAX chairman WQOW TV News 18

- Only a tenth of mortgages have an interest rate above 6% — that’s a big problem for the U.S. housing market MarketWatch

- Goldman Sachs: 10 Cities Where Home-Price Growth Is Regressing Most Business Insider

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

3 min

vs 4 min read

Condensed

86%

731 → 100 words

Want the full story? Read the original article

Read on Fortune