Stock Markets Waver Amid Trade Progress and Inflation Data

The stock market declined despite progress in US-China trade negotiations and easing inflation concerns, with upcoming PPI data expected to influence further movements.

All articles tagged with #ppi data

The stock market declined despite progress in US-China trade negotiations and easing inflation concerns, with upcoming PPI data expected to influence further movements.

The US dollar surged following the release of hot Producer Price Index (PPI) data, contributing to concerns about January inflation. Treasury yields also saw an increase, with Fed fund futures now pricing in 86 basis points in cuts this year. The market remains uncertain about the dollar's direction in light of these developments.

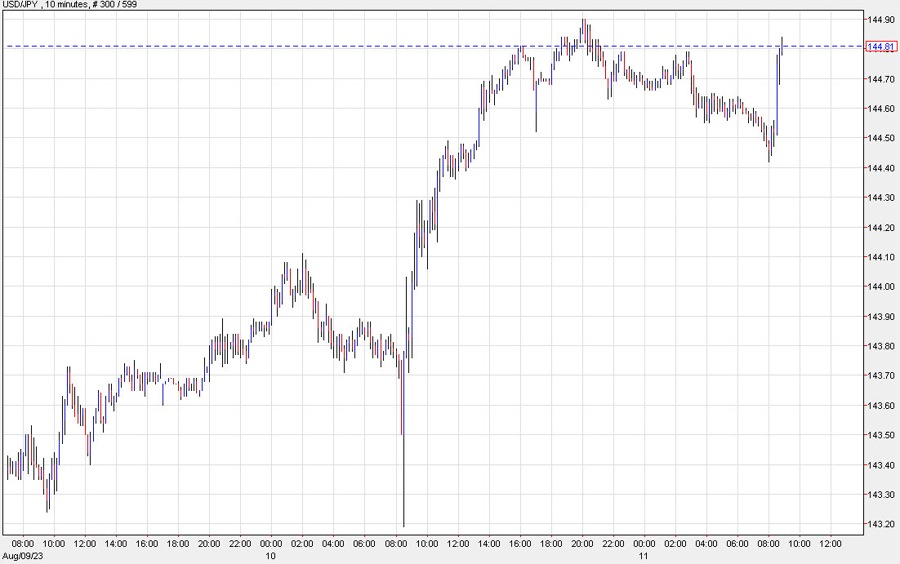

The US dollar has strengthened and yields have risen after a slightly higher-than-expected producer price index (PPI) reading. Despite the small miss, the reaction in the FX and fixed income markets has been significant, with USD/JPY approaching 145.00. These moves may indicate an underlying bias in the market, as seen with rising yields despite a cool CPI reading the day before.

Stocks have rebounded after the release of Producer Price Index (PPI) data, which showed a lower-than-expected increase in prices. The market recovery was reported by Barron's, a financial news outlet covering stocks, bonds, oil, and crypto.