Currency Market Update: US Dollar Rises Amid PPI Data and Yield Surge

TL;DR Summary

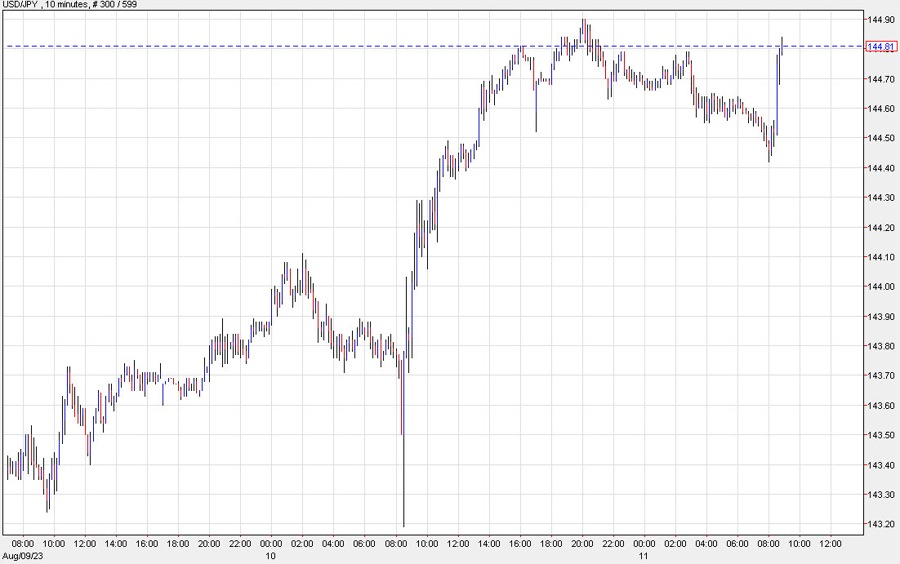

The US dollar has strengthened and yields have risen after a slightly higher-than-expected producer price index (PPI) reading. Despite the small miss, the reaction in the FX and fixed income markets has been significant, with USD/JPY approaching 145.00. These moves may indicate an underlying bias in the market, as seen with rising yields despite a cool CPI reading the day before.

- US dollar climbs and yields jump after PPI data ForexLive

- Dollar proves resilient and even strong UK GDP figures hardly dents it FXStreet

- What's Next for Yen, Euro and Pound Sterling Amid U.S. Dollar Volatility? | investing.com Investing.com

- Light changes among major currencies so far today ForexLive

- The Dollar reflects the seeming confirmation of the soft landing FXStreet

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

0 min

vs 1 min read

Condensed

60%

154 → 61 words

Want the full story? Read the original article

Read on ForexLive