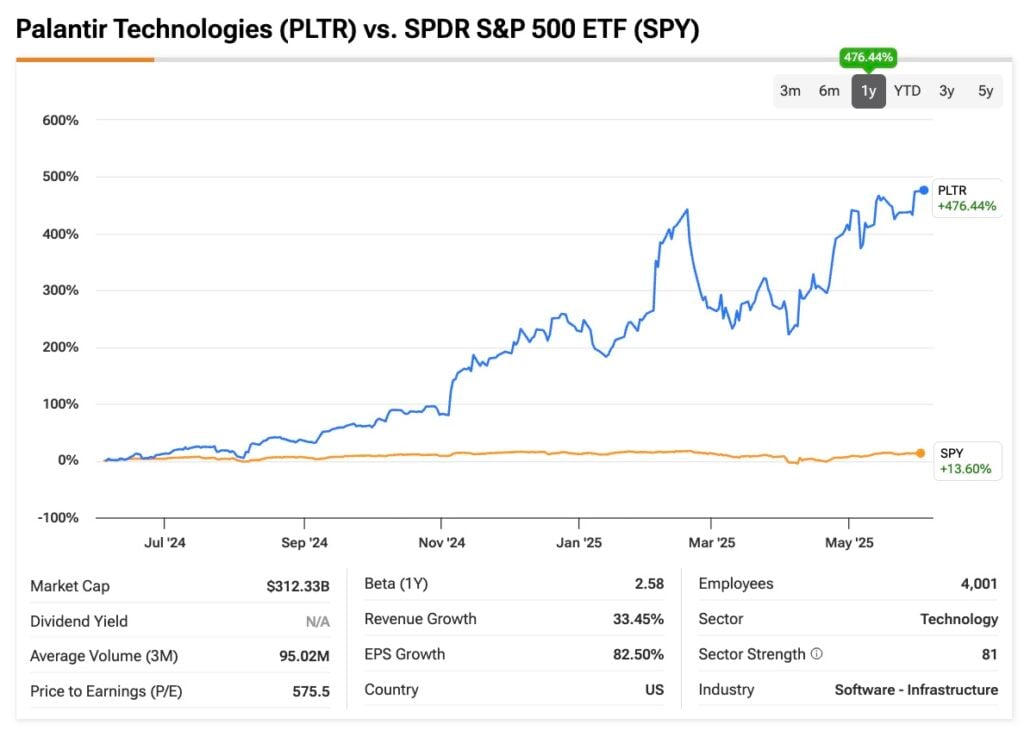

AI optimism boosts Palantir as analyst upgrades to Buy

Freedom Capital Markets analyst Almas Almaganbetov upgraded Palantir (PLTR) from Sell to Buy after strong Q4FY25 results and upbeat guidance, saying AI agents pose no long-term risk to Palantir and setting a $170 price target (about 29% upside). The company topped EPS and revenue expectations driven by its AI Platform (AIP), while estimates for 2026–27 were raised; the move contrasted with mixed views from other analysts, and PLTR climbed about 1.7% after the upgrade.