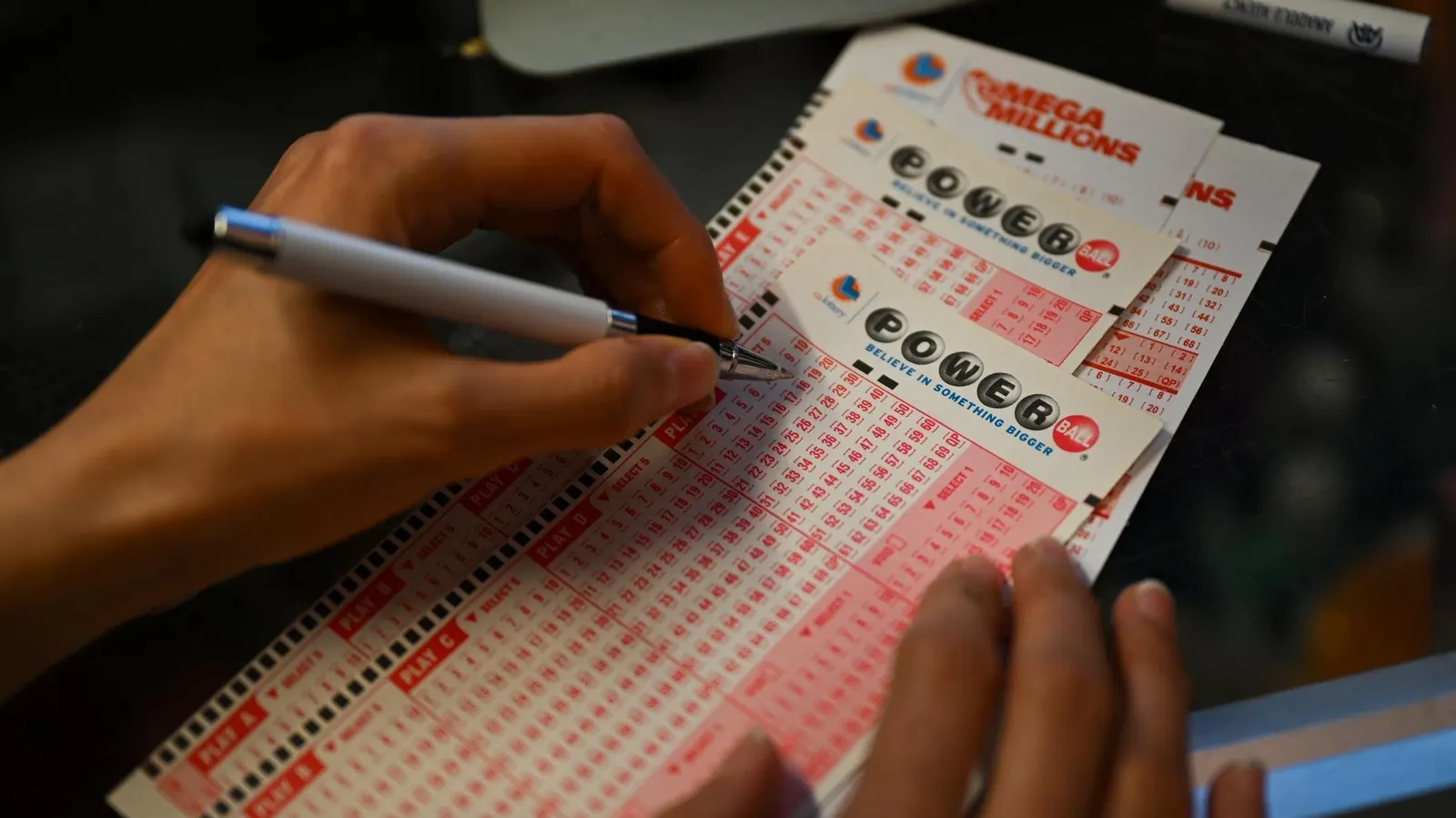

Powerball Jackpot Hits $740M Amid No Recent Winners

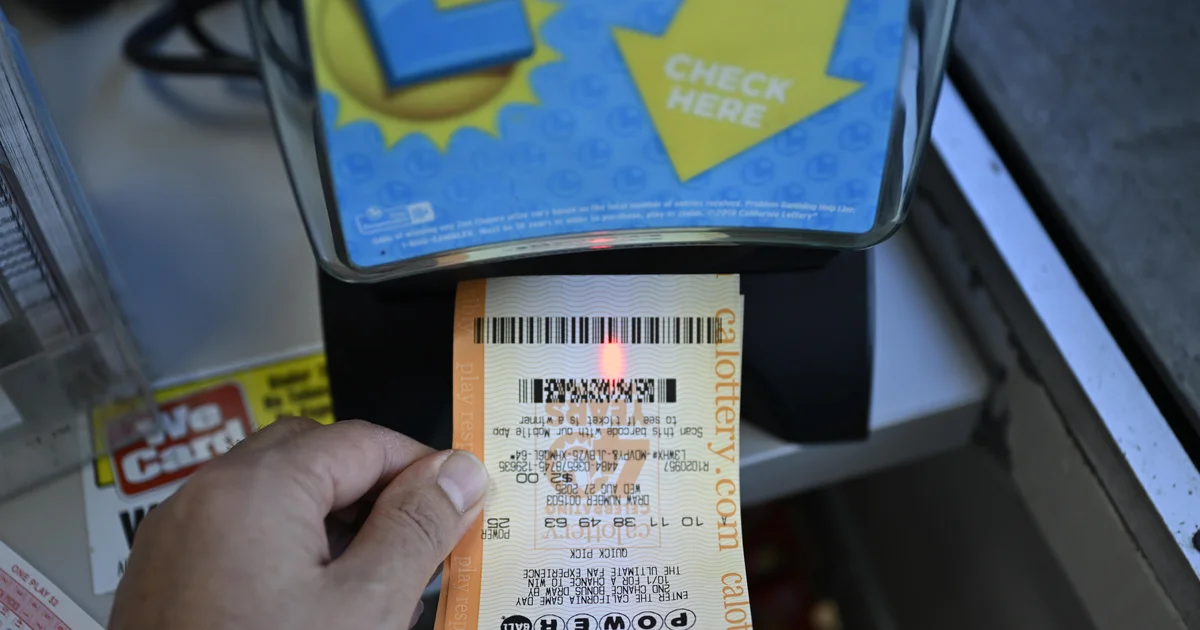

The Powerball jackpot has increased to $740 million after no winner was found in Saturday's draw. A winner could choose between receiving the full amount over 30 years or a lump sum of $346.1 million, but taxes significantly reduce the take-home amount, with federal taxes potentially lowering the lump sum to around $218 million and state taxes varying by location.