"Learning from Facebook's Success: Arm, Instacart, and Klaviyo Seek IPO Redemption"

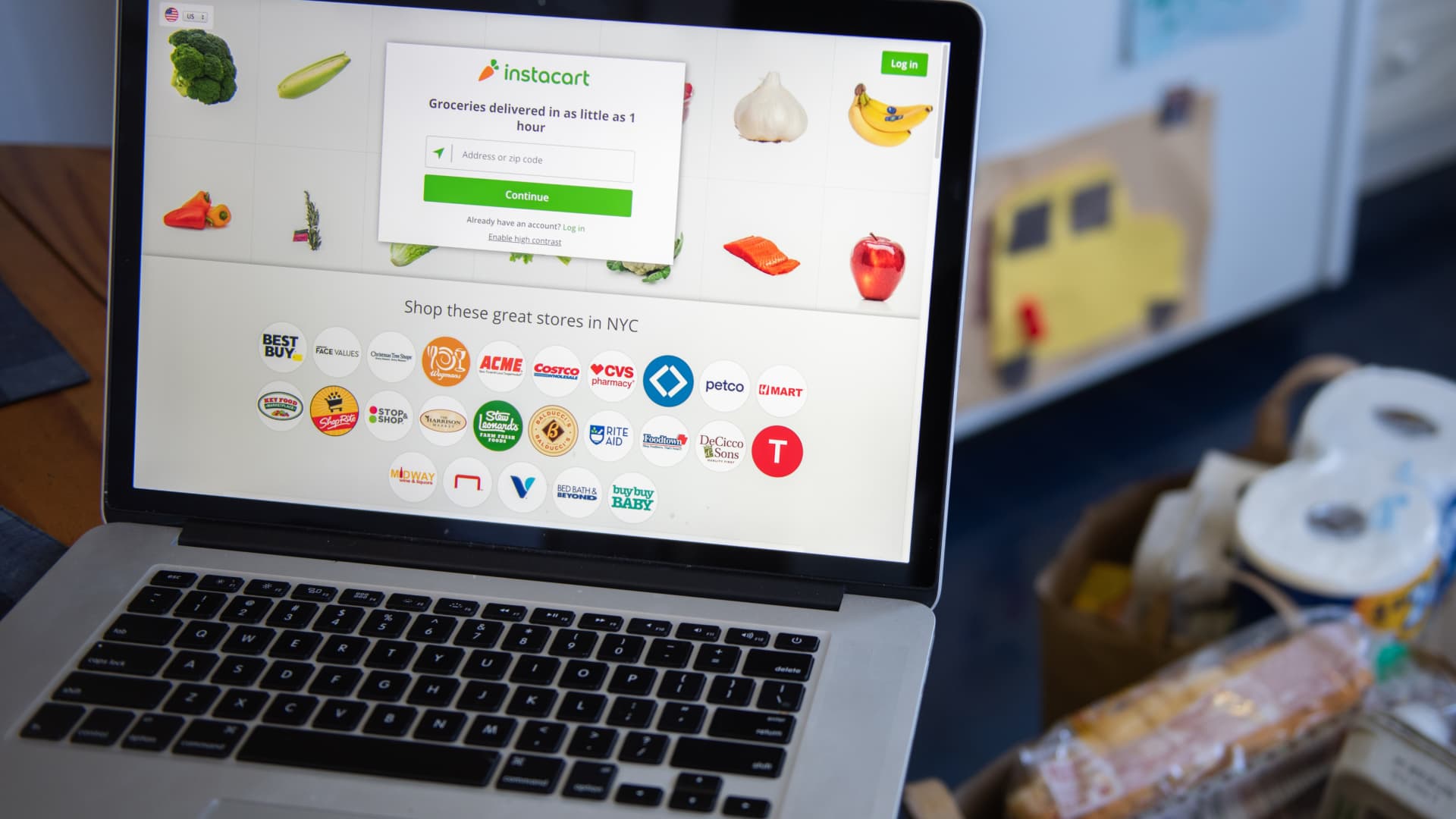

The IPOs of Arm Holdings, Instacart, and Klaviyo have experienced lackluster performances, raising doubts about the market conditions for high-stakes IPOs. Arm's shares fell consistently throughout the week, while Instacart's shares closed at the IPO price just two days after a 40% jump. Klaviyo also saw a decline in its share price on its first day. The poor performance of these tech IPOs, coupled with economic uncertainty, inflation, rising interest rates, and geopolitical tensions, has made investors and analysts skeptical. However, the example of Facebook's IPO in 2012 shows that an initial price drop does not necessarily indicate a bad trajectory in the future, as other variables such as market conditions and company fundamentals should be considered.