"Expanding Child Tax Credit: What You Need to Know"

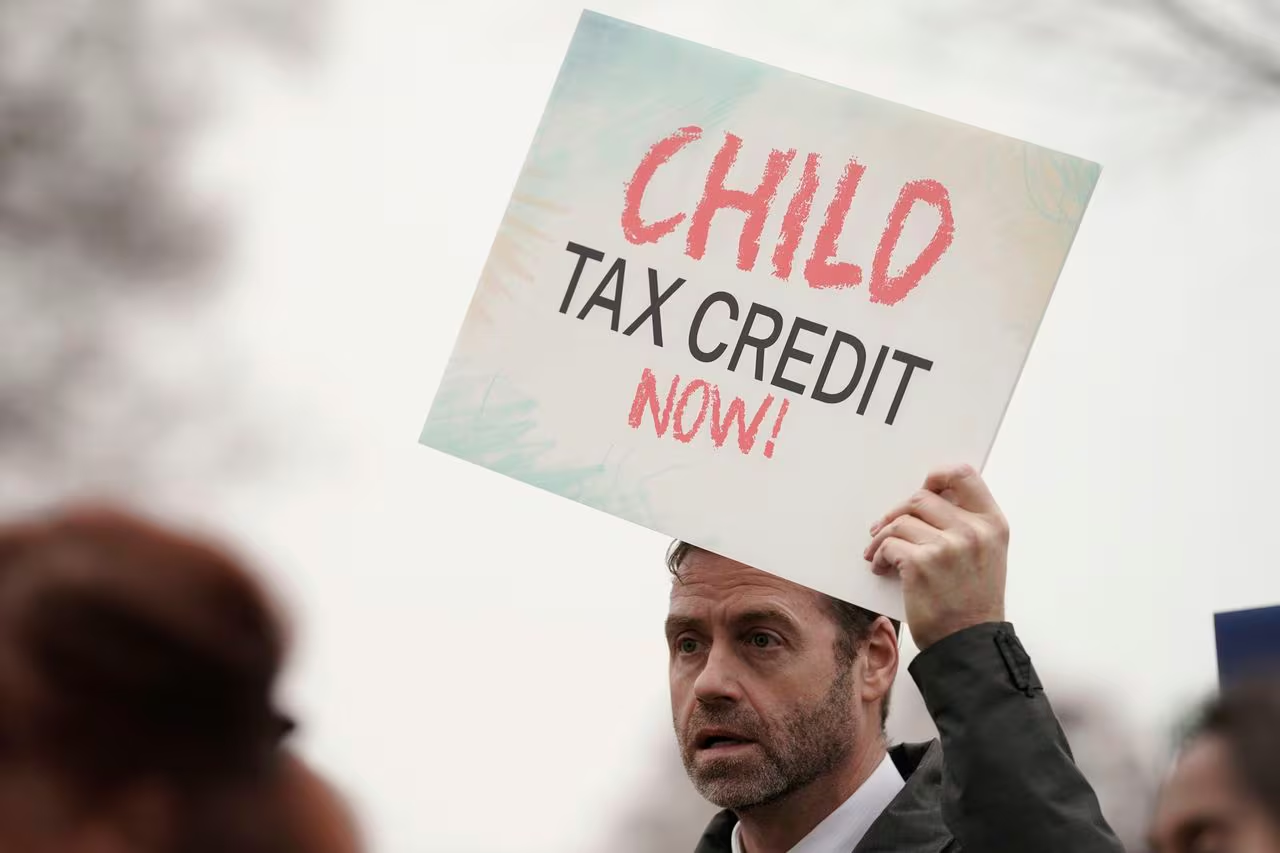

The U.S. House has passed a bill to expand the child tax credit, potentially increasing the maximum refundable amount per child over the next three years. If approved by the Senate and signed by President Joe Biden, the increased credit could retroactively apply to 2023 taxes. The eligibility criteria for the new child tax credit would remain the same as the current one, with income thresholds and other requirements.