"Expanding Child Tax Credit: What You Need to Know"

TL;DR Summary

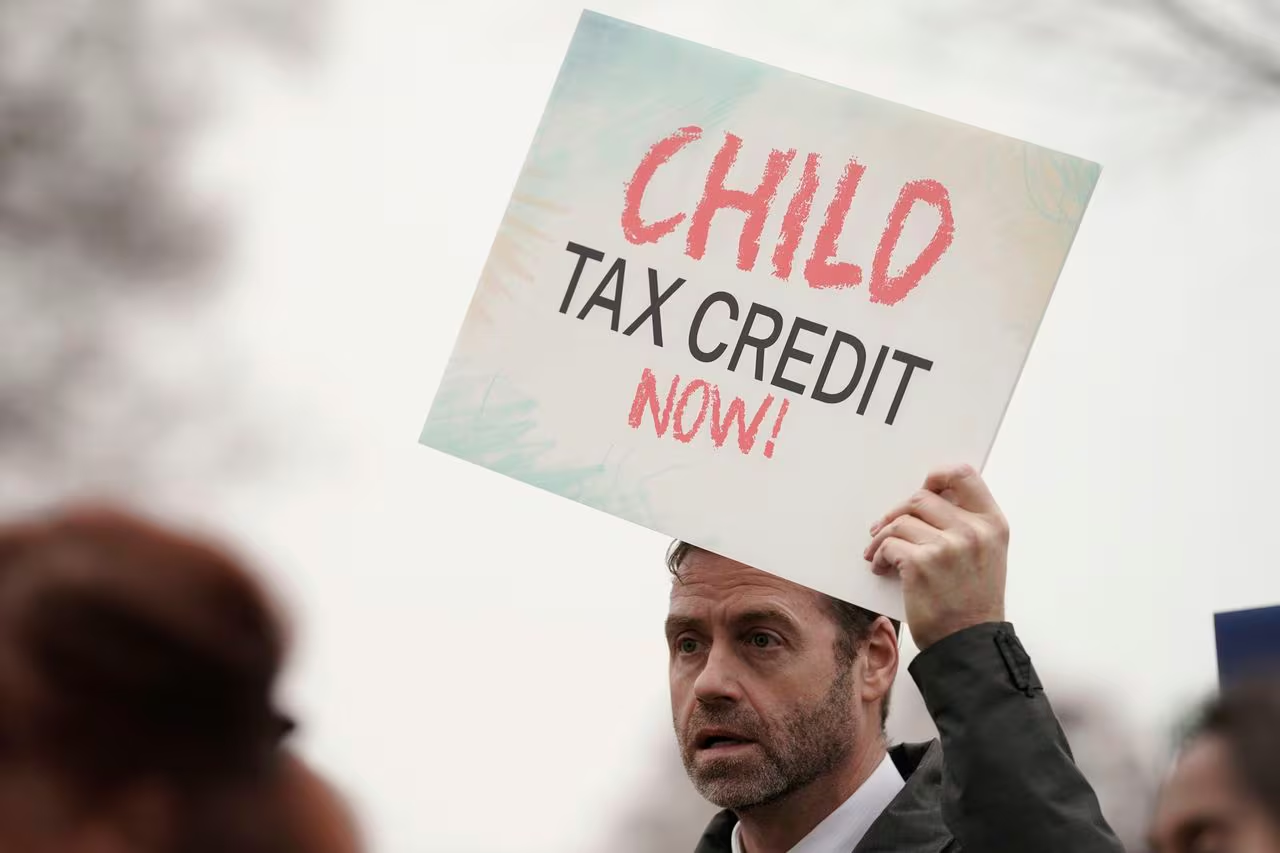

The U.S. House has passed a bill to expand the child tax credit, potentially increasing the maximum refundable amount per child over the next three years. If approved by the Senate and signed by President Joe Biden, the increased credit could retroactively apply to 2023 taxes. The eligibility criteria for the new child tax credit would remain the same as the current one, with income thresholds and other requirements.

Topics:nation#child-tax-credit#income-eligibility#refundable-tax-credit#senate#tax-relief-for-american-families-and-workers-act#taxation

- Child tax credit passes House: How much could you get this year? AL.com

- Child tax credit expansion: Who gets the money if it passes? The Hill

- Nearly 1 in 5 eligible taxpayers don't claim this 'valuable credit,' IRS says CNBC

- Washington's Welfare Uniparty - WSJ The Wall Street Journal

- House passes bipartisan tax bill that expands child tax credit CNN

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

2 min

vs 3 min read

Condensed

87%

540 → 69 words

Want the full story? Read the original article

Read on AL.com