ImmunityBio’s ANKTIVA Delivers 700% Revenue Jump, Expands to 33 Countries and Secures First Lung Cancer Approval

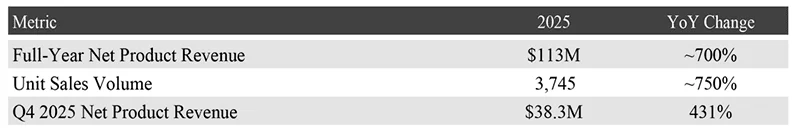

ImmunityBio reports 2025 ANKTIVA net product revenue of about $113 million (up ~700% YoY) with 750% unit growth, expanding approvals to 33 countries across four jurisdictions and securing Saudi Arabia’s first lung-cancer approval, while strengthening European and Middle East partnerships and outlining a 3-year plan to use ANKTIVA as the Cancer BioShield backbone across multiple trials.