"Maximize Your Employee Benefits: Don't Waste Your FSA Money Before the New Year"

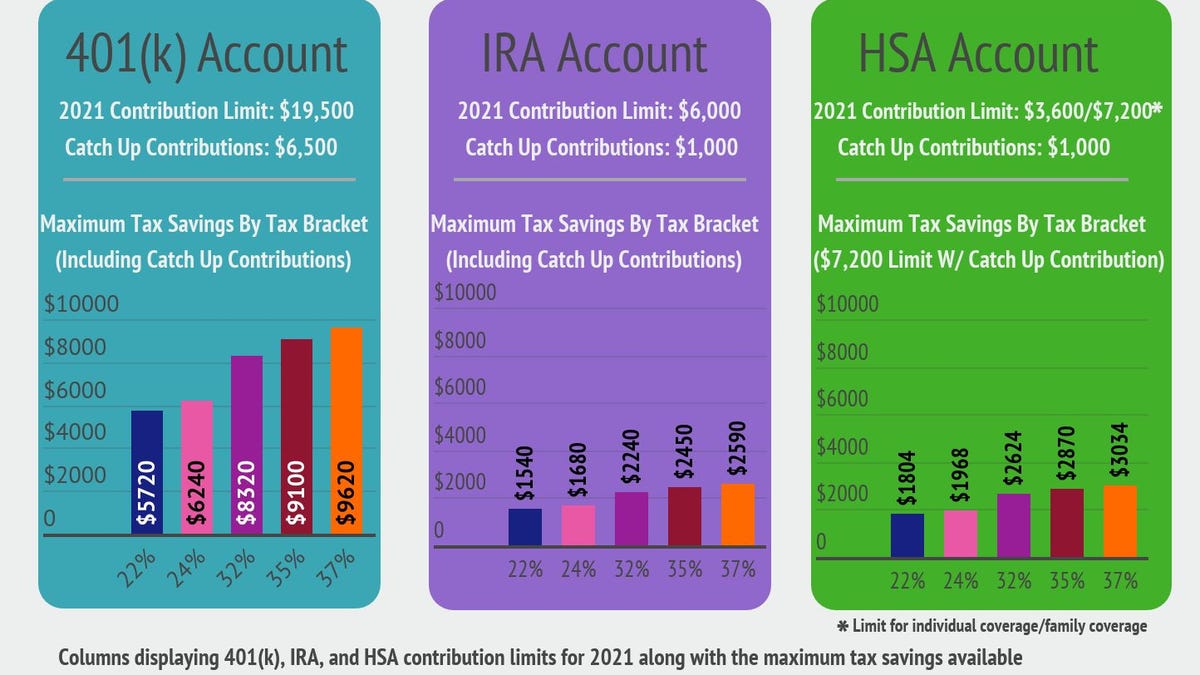

As the end of the year approaches, it's important to maximize your employee benefits before they expire or reset. Take advantage of flexible spending accounts (FSAs) by using any remaining funds for eligible expenses. Consider maximizing contributions to health savings accounts (HSAs) before the year ends, as unused funds roll over. Use any remaining flex time, work-from-home days, or paid time off. Review your retirement savings and adjust contributions if necessary. Lastly, explore other employee perks and discounts that you may have overlooked. Being proactive now can lead to significant savings and optimized benefits for the new year.