"2024 Brings Record Boost to HSA Caps: What You Need to Know"

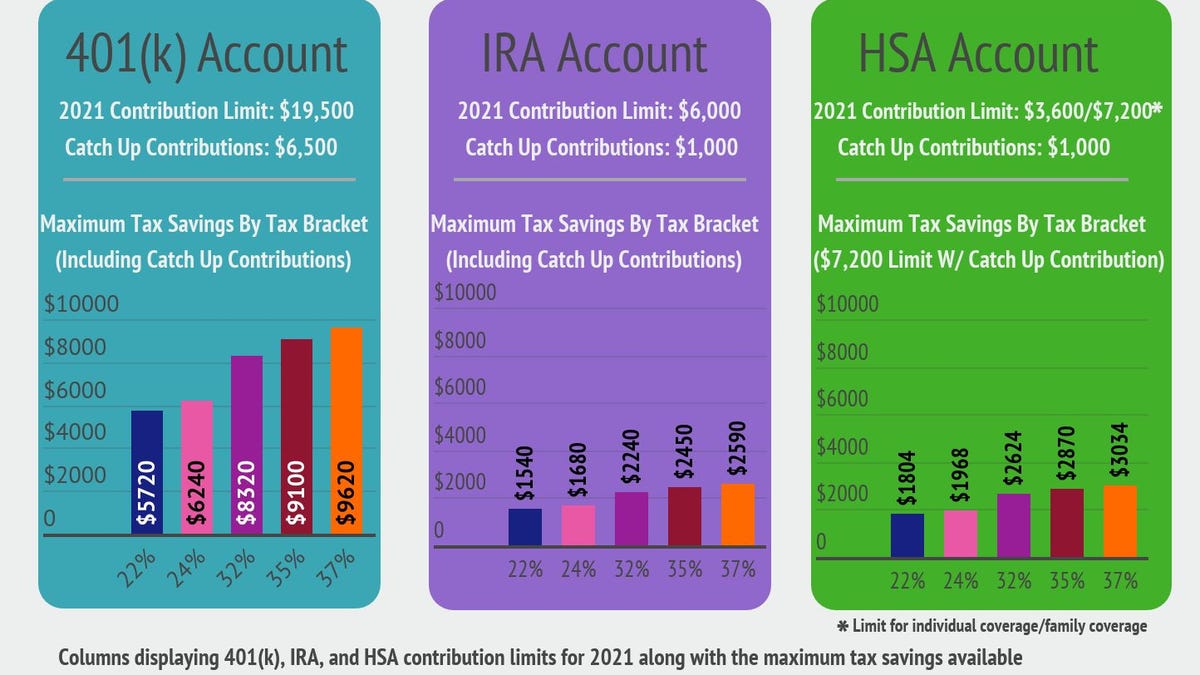

The IRS is increasing the maximum contribution limits for health savings accounts (HSAs) in 2024 to $8,300 for families and $4,150 for individuals, up from $7,750 and $3,850, respectively. Participants age 55 and older can contribute an extra $1,000, allowing older married couples to save up to $10,300 a year. HSAs are tax-advantaged accounts that can be used to save for medical expenses, and contributions are immediately tax-deductible. Contributions can also be invested and grow tax-free, and distributions for qualified medical expenses are tax-free. However, most people use their HSAs to pay for current expenses and contribute little, and relatively few invest.

- Health savings account 2024 caps see record boost. Why you should care USA TODAY

- HSA Limits Are Going Up in 2024. Here's What You Need to Know The Motley Fool

- Couples 55 and older will be able to contribute more than $10,000 to health savings accounts NBC News

- Couples Age 55 or Older Can Soon Contribute $10,000 a Year to Health Savings Accounts U.S. News & World Report

- Here's What Happens to Your HSA if You Change Jobs The Motley Fool

Reading Insights

0

2

4 min

vs 5 min read

88%

828 → 102 words

Want the full story? Read the original article

Read on USA TODAY