Wall Street Declines as Markets React to Fed and Crypto Movements

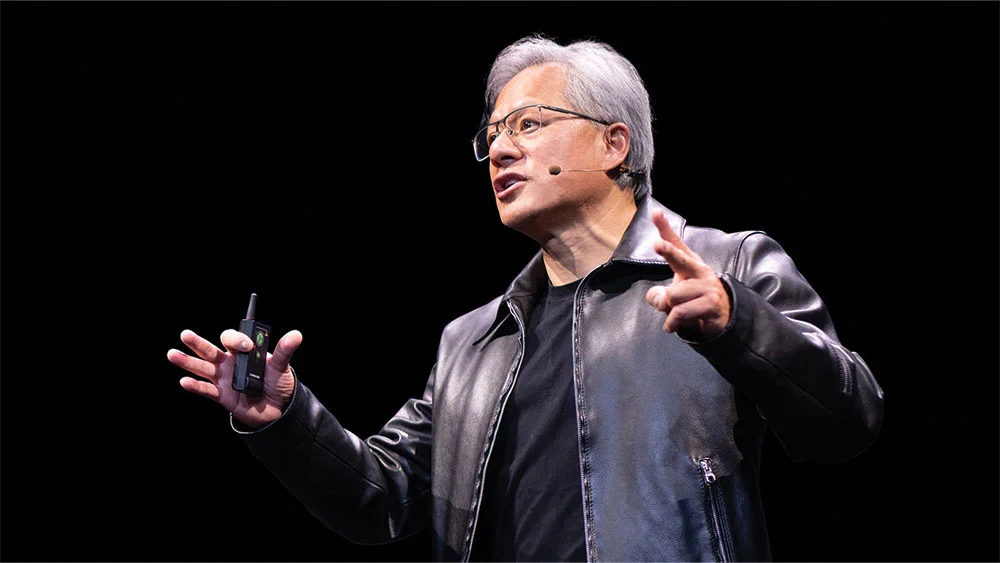

The stock market started December with declines, with the Dow falling over 200 points and major indexes struggling to build on last week's gains. Synopsys surged on a $2 billion investment from Nvidia, though it faced resistance at its 50-day moving average. Gold stocks, like Triple Flag Precious Metals, showed strength, while energy stocks outperformed. Overall, market sentiment remains cautious amid mixed earnings and economic data expectations.