Opportunity Knocks: Discounted Dividend Growth Stocks

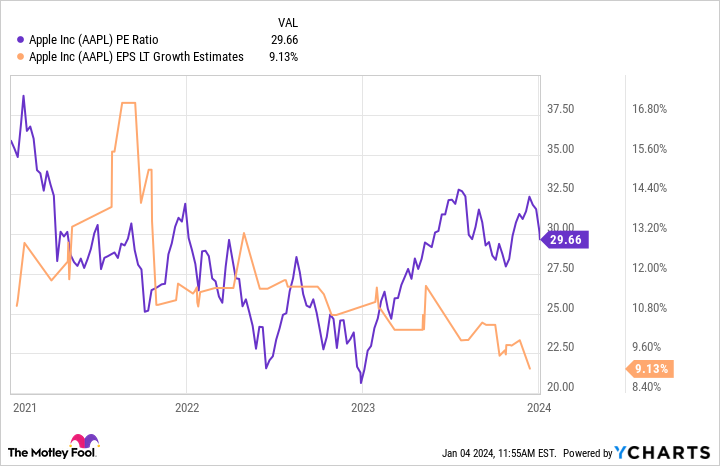

The article discusses the opportunity to invest in dividend growth stocks that are currently undervalued, suggesting that these stocks are "too cheap" and present a buying opportunity. The author discloses a personal investment in WES and clarifies that the opinions expressed are personal and not influenced by Seeking Alpha, which does not provide investment advice or recommendations.