Bitcoin Plummets: Volatile Market Reacts to Economic Shifts

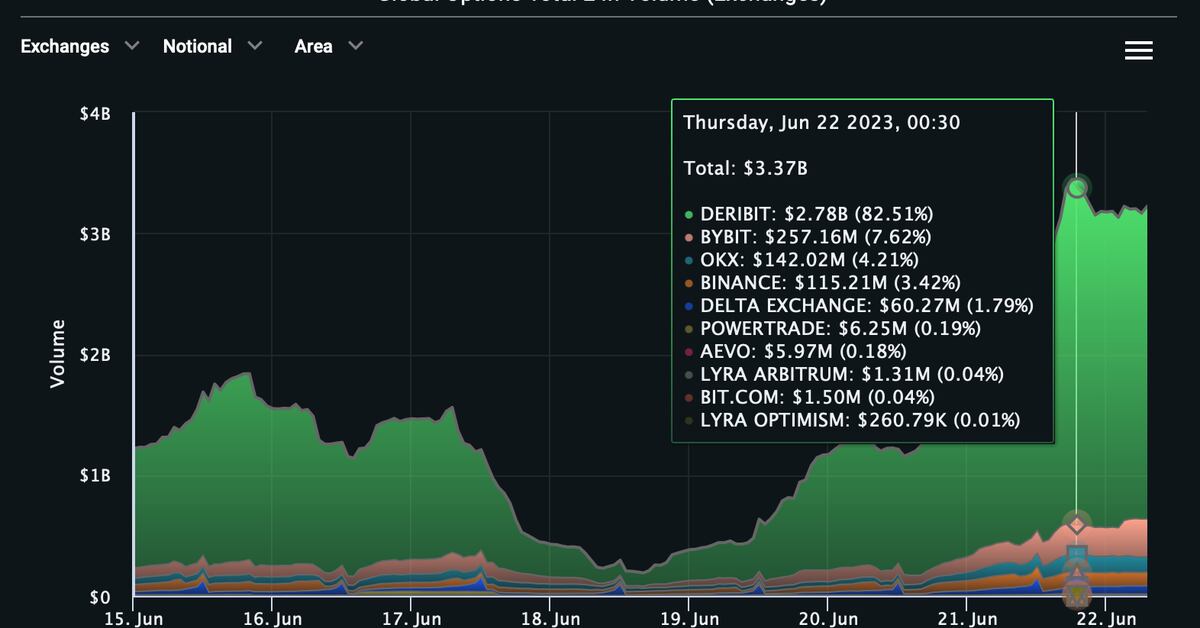

Bitcoin faces selling pressure as it drops to $65,742 ahead of its upcoming halving event, with analysts expecting a period of correction and consolidation. The broader crypto market also sees losses, with ether, Solana's SOL, and dogecoin registering larger drops. Ethena Labs opens claims for its new governance token, ENA, while Deribit's Dubai-based unit wins a conditional virtual asset provider license, allowing it to operate as a virtual asset exchange for spot and derivatives trading once all conditions are met.