Bitcoin Surges as Options Volume and Institutional Interest Rise.

TL;DR Summary

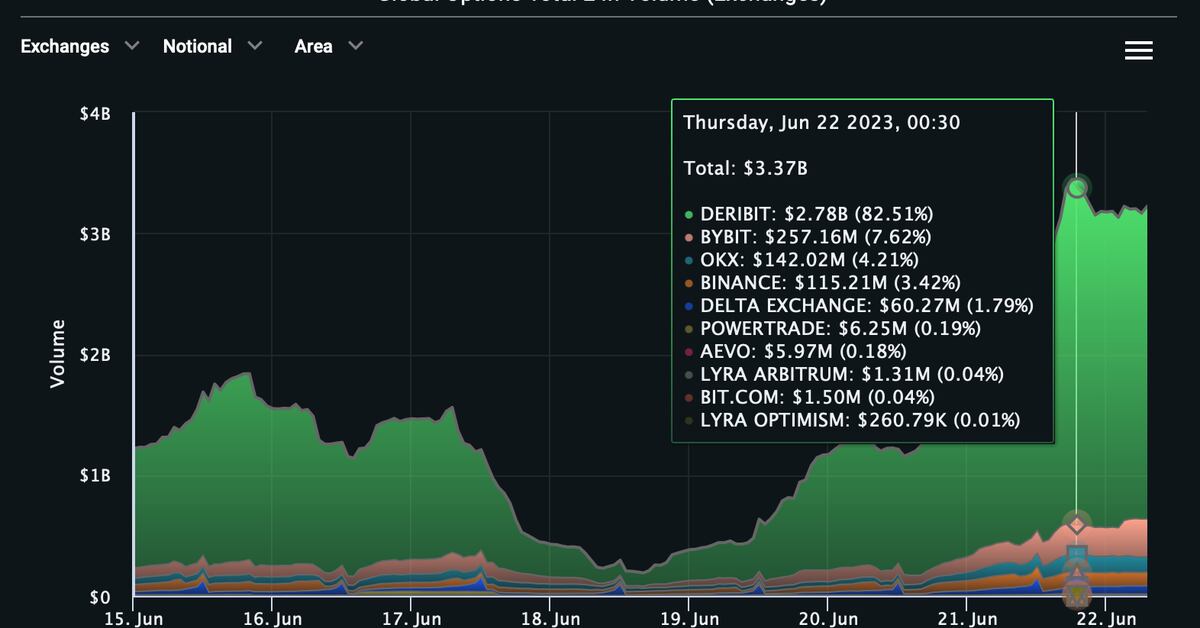

Bitcoin's sudden rally to two-month highs has spurred demand for calls and boosted activity in the options market. On Wednesday, bitcoin options contracts worth $3.3 billion changed hands across major exchanges, including Deribit. That's the highest single-day notional volume in three months. Call options at strike prices of $30,000, $31,000, $32,000 and $40,000 have been popular among traders in the past 24 hours. The increased demand for options pushed Deribit's bitcoin volatility index, DVOL, to 59.24, the highest since early April.

- Bitcoin Options Volume Jumps to $3.3B as Price Rallies to Two-Month High CoinDesk

- Bitcoin Hits $29,000 Following BlackRock, WisdomTree, Invesco ETF Filings Decrypt

- ‘The Great Accumulation’ of Bitcoin has begun, says Gemini’s Winklevoss Cointelegraph

- Bitcoin Breaks $30K Amid TradFi Push Into Crypto CoinDesk

- Bitcoin (BTC) Market Analysis for June 22, 2023 - Bullish but Volatile CryptoGlobe

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

2 min

vs 3 min read

Condensed

84%

510 → 81 words

Want the full story? Read the original article

Read on CoinDesk