Deposit Delays Plague US Banks Following Processing Network Error

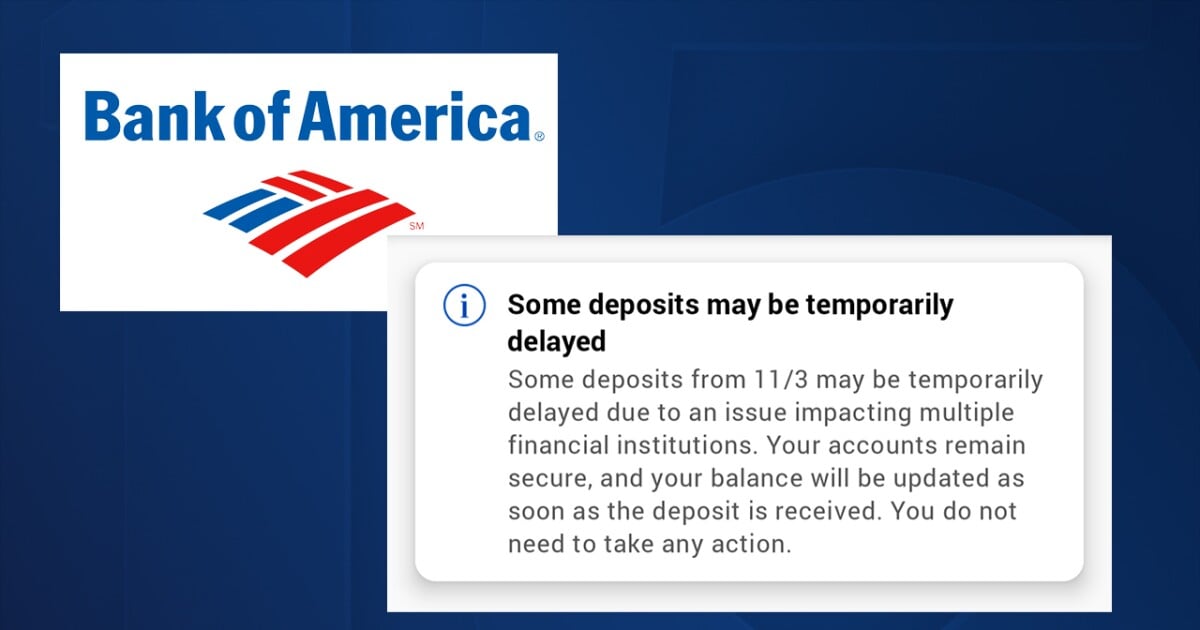

Multiple US banks experienced deposit delays due to an error at a payment processing network operated by The Clearing House, affecting less than 1% of the daily ACH volume. The issue, caused by a manual error and not a cybersecurity breach, impacted various bank transactions, including direct deposits and bill payments. Banks assured customers that their deposits remained secure and that the problem was being addressed. The ACH system, which processes millions of transactions daily, is operated by the Federal Reserve Banks and the Electronic Payment Network.