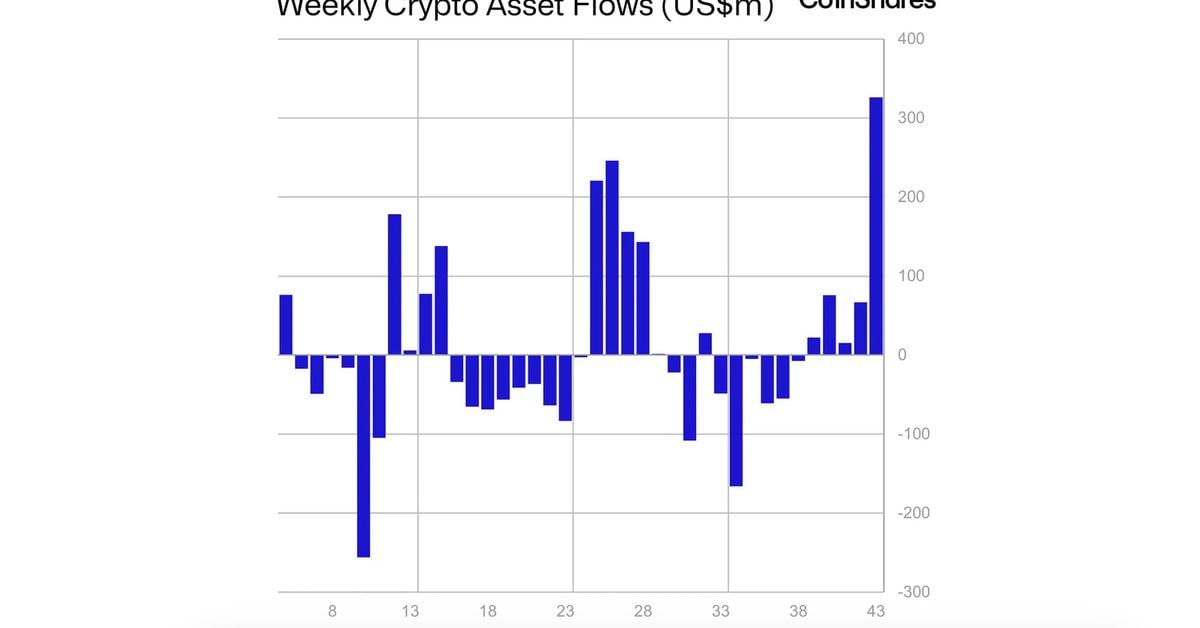

Crypto investment products have seen a surge in investor interest, with over $500 million in inflows over the past week, bringing the year-to-date inflows to $5.7 billion. The influx has been primarily driven by the introduction of new spot Bitcoin exchange-traded funds (ETFs) in the United States, accounting for 55% of the record inflows witnessed throughout 2021. US-based funds led the way with the largest inflows, while Bitcoin-based funds dominated the inflows, attracting $570 million in investments. Despite the positive momentum, certain assets faced challenges, with Solana investment products seeing outflows for the second consecutive week. However, the overall trajectory of the global cryptocurrency market has been largely positive, with the total market capitalization of crypto assets surpassing the $2 trillion mark.