Trump's Asia Tour Highlights Japan Relations and Trade Outlook

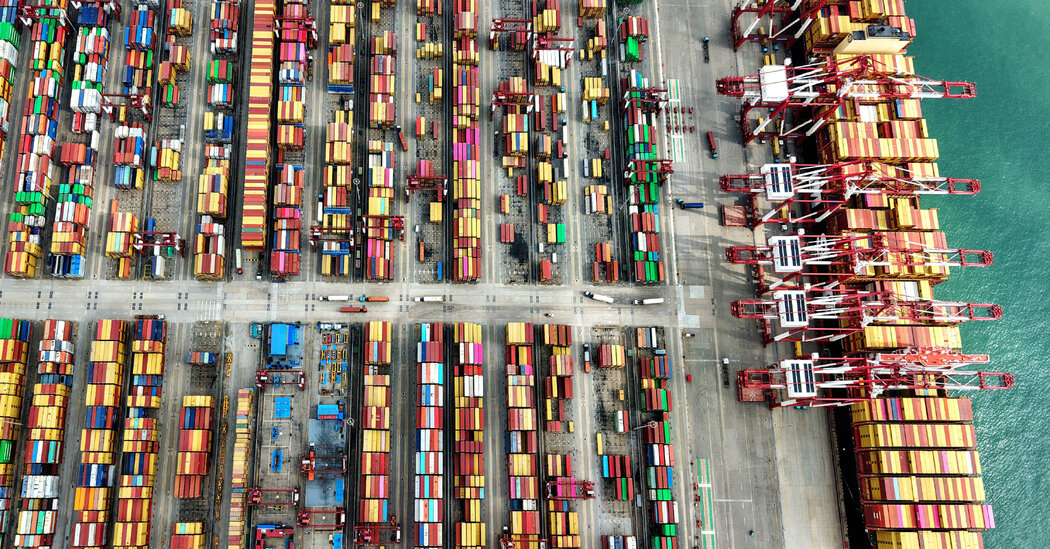

President Trump, during his Asia tour, predicted a quick resolution to the US-China trade negotiations, expecting a deal to be finalized within days, while also engaging in diplomatic meetings in Japan and Southeast Asia, emphasizing trade and regional security issues.