"Top 5 High-Yield Dividend Stocks for Long-Term Investors"

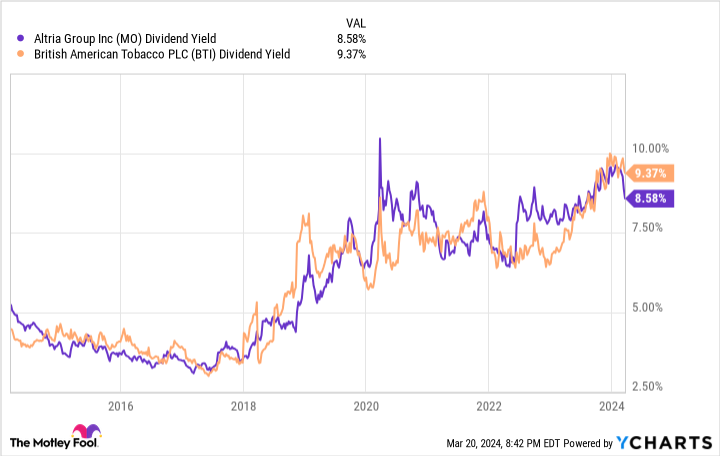

Pfizer and Altria Group are two high-yield dividend stocks that income-seeking investors can consider for long-term investment. Despite challenges such as declining sales of COVID-19 products for Pfizer and a shift away from combustible cigarettes for Altria, both companies have a history of raising their dividend payouts and currently offer yields above 6%. Pfizer's investment in new drugs and Altria's acquisition of NJOY, a FDA-authorized e-cigarette product, could contribute to their long-term growth potential. However, investors should also consider other top stock picks identified by The Motley Fool's Stock Advisor service for potential high returns.