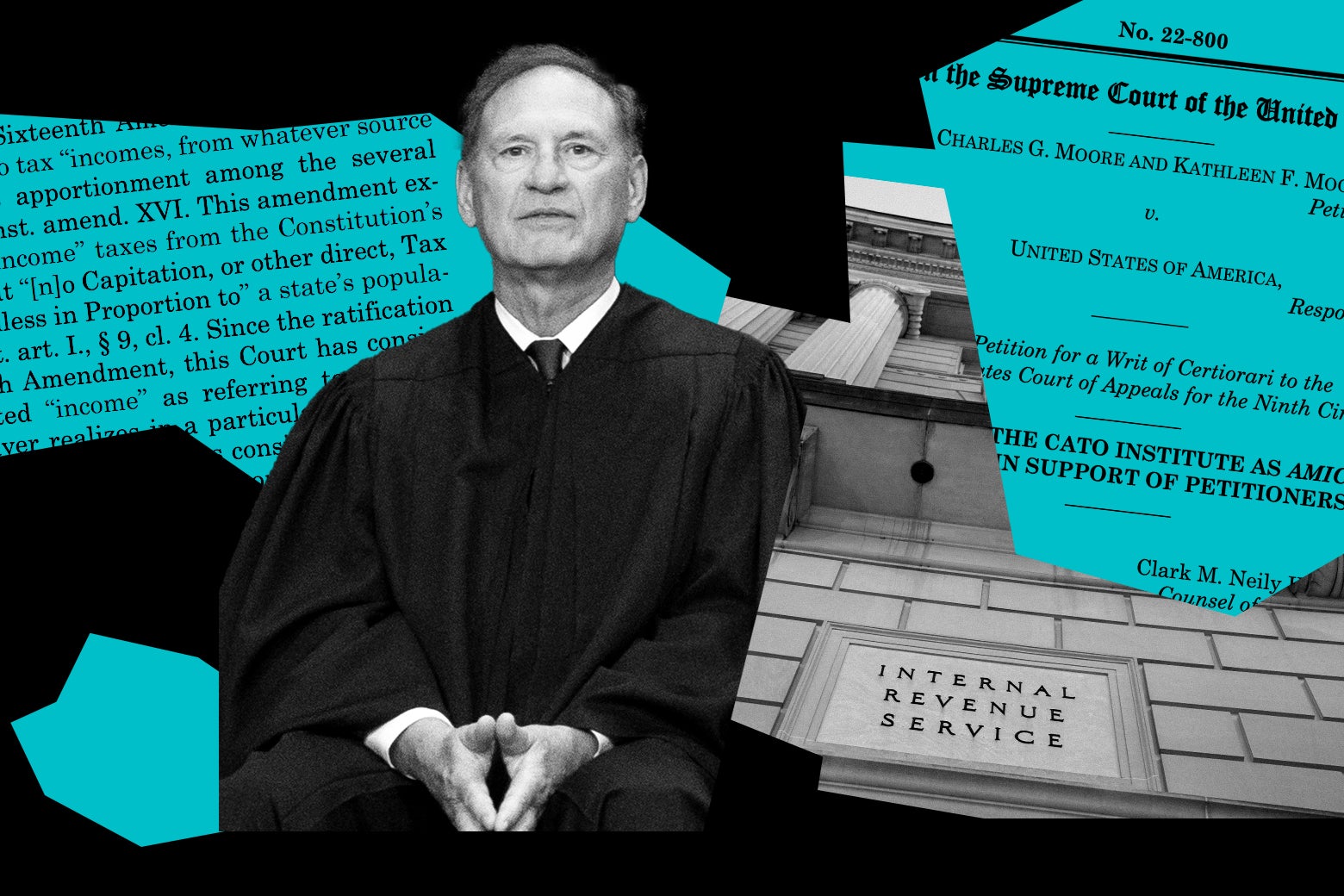

Supreme Court Weighs in on Tax Code and Foreign Income, Leaving Wealth Tax Unresolved

The Supreme Court heard arguments in the case of Moore v. United States, which raises questions about what constitutes income and when the federal government can tax it. The case involves a wealthy couple seeking a tax refund on profits accumulated by a foreign corporation in which they held a controlling stake. The couple argues that they had no income to be taxed because they never received any dividends. The Court's justices seemed skeptical of this argument, suggesting that they are adopting a "first do no harm" approach regarding the tax code. While the Court's ruling may not directly address the constitutionality of a billionaire wealth tax, it could have implications for future tax legislation.