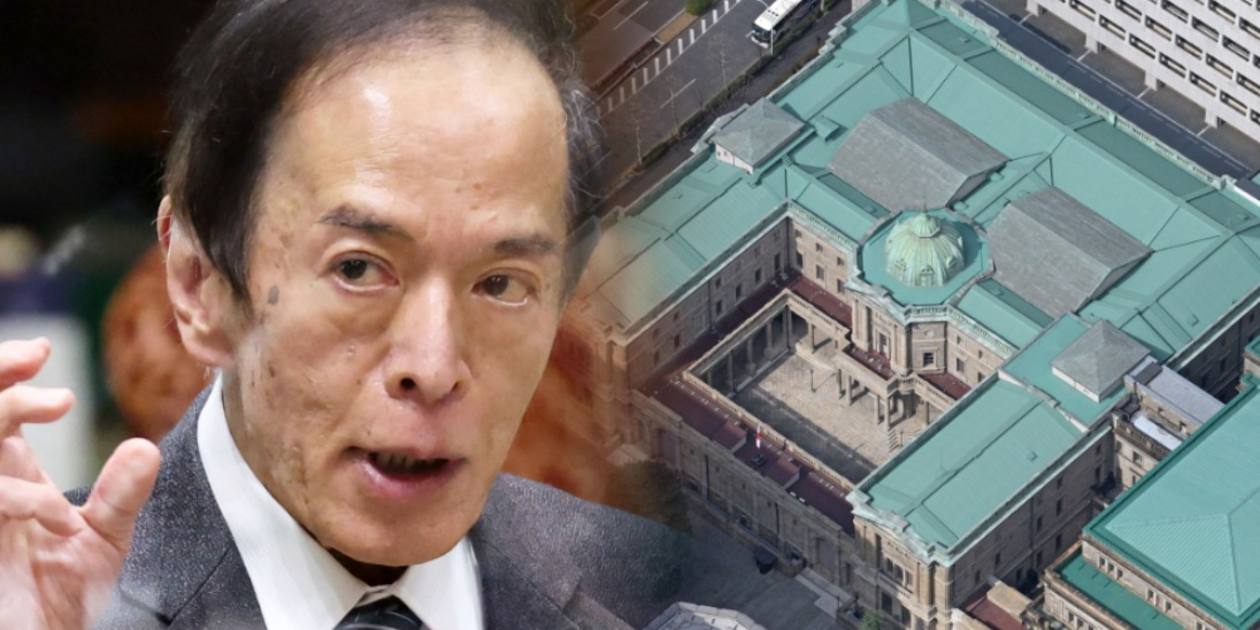

BOJ's Yield Curve Control Shift Raises Concerns of Financial Instability

TL;DR Summary

The Bank of Japan has adjusted its ultra-easy monetary policy by discarding an explicit ceiling for 10-year Japanese government bond yields. In response to rising prices and the weakening yen, the central bank introduced more policy flexibility and established 1% as a new reference point for 10-year yields.

Topics:top-news#bank-of-japan#inflation#japanese-government-bonds#monetary-policy#yield-curve-control

- BOJ drops explicit 1% ceiling for 10-year JGB yields Nikkei Asia

- Bank of Japan increases flexibility on yield curve control, keeps rates unchanged CNBC

- A disorderly shift in Japan's monetary policy could spark bond-market contagion and increase risks of a 'financial accident,' Mohamed El-Erian says Yahoo Finance

- BOJ Shuffles Away from YCC, But Don't Tell Anyone Bloomberg

- YCC Verdict: Bank of Japan Is Guilty of a Messaging Mistrial Bloomberg

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

1 min

vs 1 min read

Condensed

73%

175 → 48 words

Want the full story? Read the original article

Read on Nikkei Asia