Palo Alto Networks Faces Stock Plunge After Revenue Guidance Cut

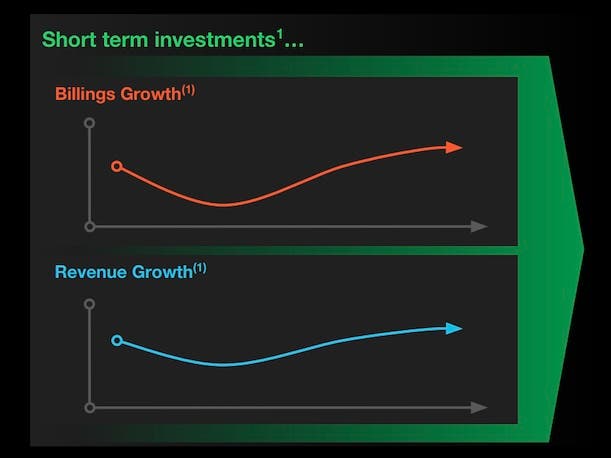

Palo Alto Networks CEO Nikesh Arora announced a dramatic shift in the company's growth strategy, aiming to accelerate consolidation onto its unified security platform despite a short-term hit to growth. This includes offering free product incentives to customers to drive adoption of more tools on its platform. The company expects a 12 to 18-month recovery period for its growth rate and aims to reach $15 billion in annual recurring revenue by fiscal 2030. The platform approach, which includes 16 acquisitions, is central to the company's strategy, focusing on building a comprehensive cybersecurity platform covering network security, cloud and applications protection, secure access service edge (SASE), zero trust security, and AI-powered threat detection.

- Palo Alto Networks CEO: 'We Firmly Believe' Dramatic Shift In Growth Strategy Will Pay Off CRN

- Palo Alto Networks shares plunge after company cuts full-year billings, revenue guidance CNBC

- Palo Alto Networks stock plunges on full-year revenue guidance cut Yahoo Finance

- Palo Alto Earnings Top Views; Shares Tumble On Weak Guidance Investor's Business Daily

- Palo Alto Networks (PANW) Q2 2024 Earnings: What to Expect Nasdaq

Reading Insights

0

0

3 min

vs 4 min read

85%

766 → 112 words

Want the full story? Read the original article

Read on CRN