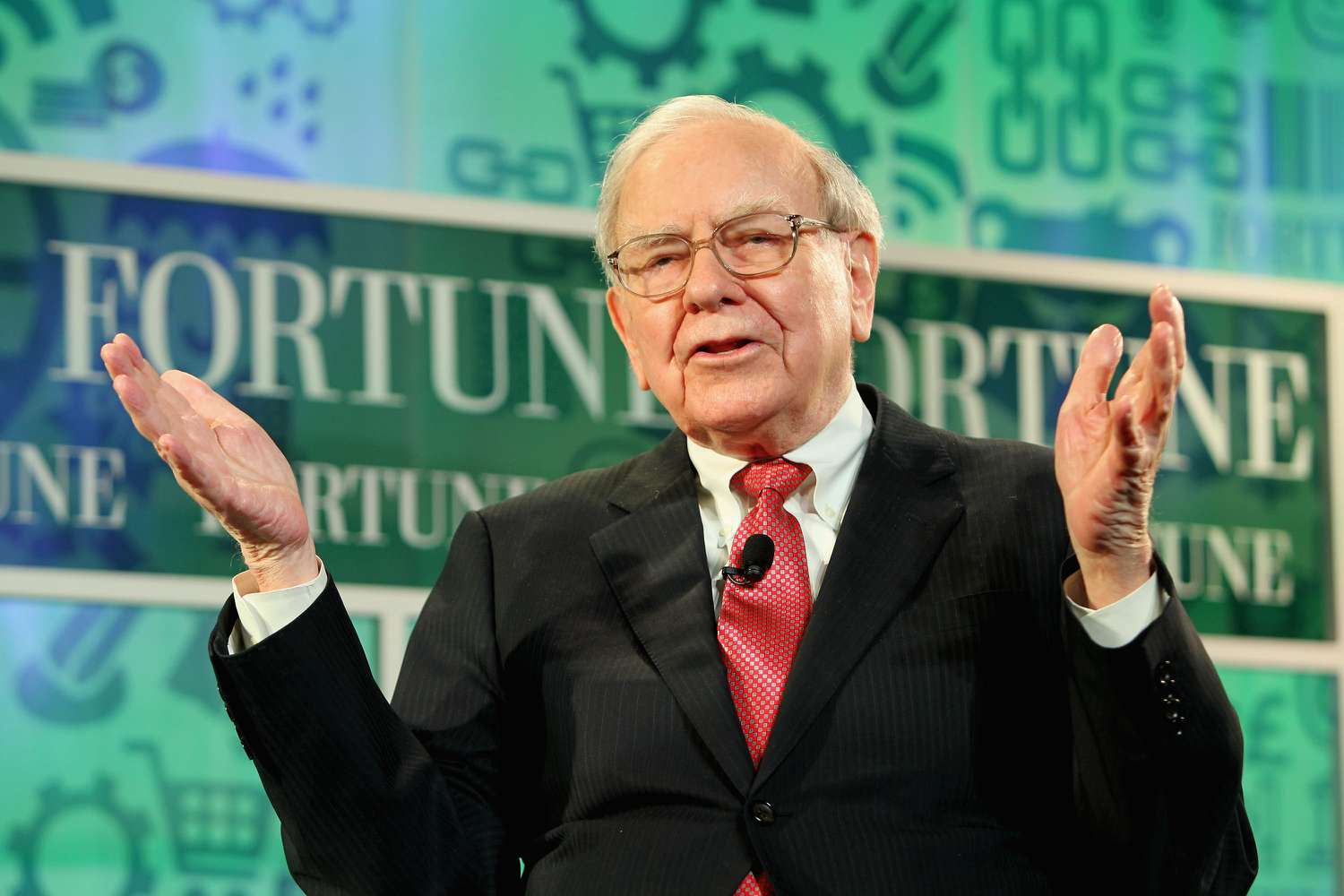

Warren Buffett's Latest Bank Investments and Sales.

TL;DR Summary

Warren Buffett's Berkshire Hathaway added a $954 million position in Capital One, exited its $1.14 billion position in BNY Mellon and a $290 million position in US Bancorp, and cut its holdings in Chevron and General Motors. Apple remains Berkshire's largest stock holding. Berkshire also purchased shares in UK drinks maker Diageo and exited its stake in Taiwan Semiconductor.

- Warren Buffett Buys Capital One, Dumps BNY Mellon Investopedia

- Warren Buffett sells stakes in two banks, raises Bank of America bet Yahoo Finance

- Berkshire Hathaway: Here Are the Stocks Warren Buffett and Co. Bought and Sold Barron's

- Berkshire invests in Capital One, sheds four stocks Reuters

- Stocks moving in after-hours: Berkshire Hathaway, Capital One, Beam, Tesla Yahoo Finance

Reading Insights

Total Reads

0

Unique Readers

2

Time Saved

2 min

vs 2 min read

Condensed

84%

360 → 59 words

Want the full story? Read the original article

Read on Investopedia