The Rise and Fall of Carl Icahn's Enterprises.

TL;DR Summary

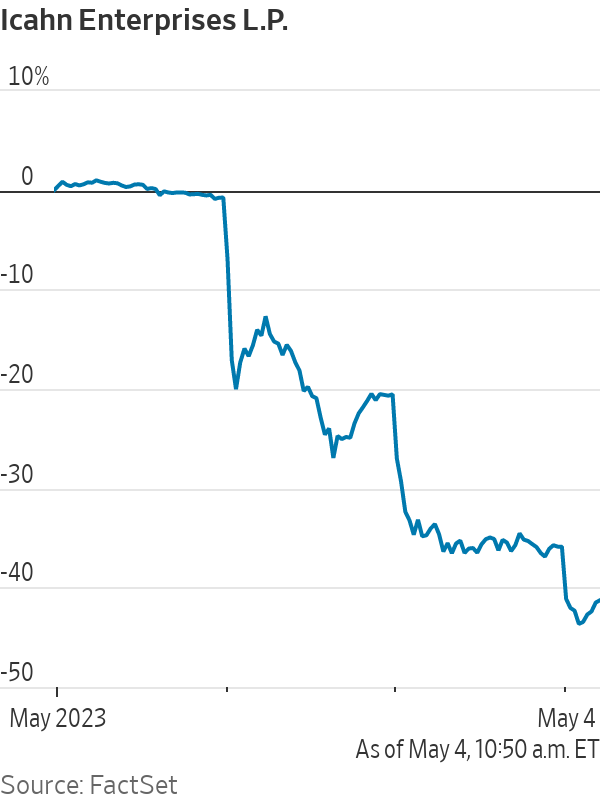

Icahn Enterprises has lost $7.5 billion in value since a short-seller report alleged the company was overvalued, over-leveraged, and overstated the value of its holdings. Shares in Icahn have declined more than 40% since the report was published. The company has pushed back its quarterly earnings call to May 10 and maintains that it stands by its public disclosures.

Topics:business#carl-icahn#finance#icahn-enterprises#quarterly-earnings#short-seller-report#stock-market

- Icahn Enterprises Stock Still Falling After Hindenburg Report The Wall Street Journal

- 'I think he's earned it', says Wolfpack's Dan David on criticism leveled at Carl Icahn's group CNBC Television

- Icahn Enterprises to give $2 per depositary unit days after Hindenburg report Yahoo Finance

- Icahn Enterprises: How Good Is This 25% Yield? (NASDAQ:IEP) Seeking Alpha

- Carl Icahn the Hunter Has Become the Hunted Bloomberg

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

0 min

vs 1 min read

Condensed

43%

103 → 59 words

Want the full story? Read the original article

Read on The Wall Street Journal