The Consequences of Unpaid Student Loans: Borrowers Worry as Payments Resume

The Biden administration is providing an "on-ramp period" until September 30, 2024, allowing borrowers to skip payments without defaulting on their student loans. During this period, borrowers won't be reported as being in default, but interest will still accrue. Defaulting on student loans can damage credit scores, making it harder to buy a car or house, and result in financial consequences such as withheld tax refunds or wages. Once in default, borrowers lose eligibility for deferment or forbearance and may be taken to court. It's important to consider switching to income-driven repayment plans to lower monthly payments, and borrowers who fell into default before the pandemic pause can apply for the Department of Education's "Fresh Start" program to remove the default from their credit report.

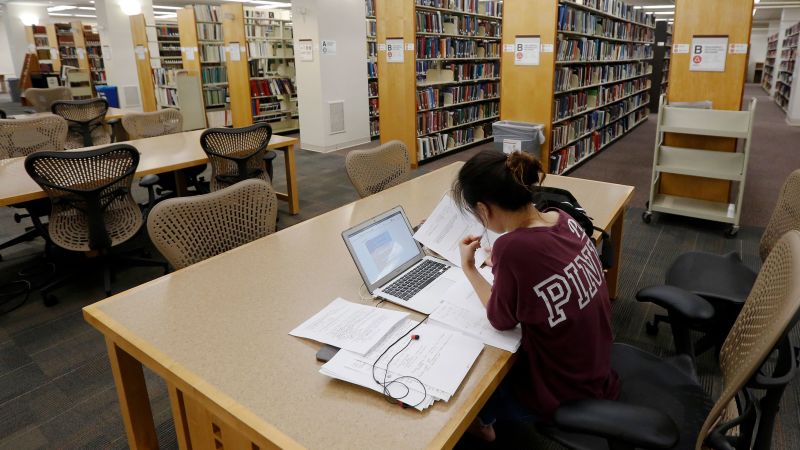

- What happens if you don’t pay your student loans? CNN

- Student loan borrowers nervous about payments resuming, survey says WCCO - CBS Minnesota

- Student loans: Predatory lending isn’t just coming from for-profit schools Yahoo Finance

- Student loan survival guide: Navigating repayments in a post-pause era KMBC 9

- Could a government shutdown impact student loan payments resuming? KRQE News 13

Reading Insights

0

6

3 min

vs 4 min read

81%

649 → 125 words

Want the full story? Read the original article

Read on CNN