"Tech Selloff Sparks Stock Tumble: Intel and Visa in Focus"

TL;DR Summary

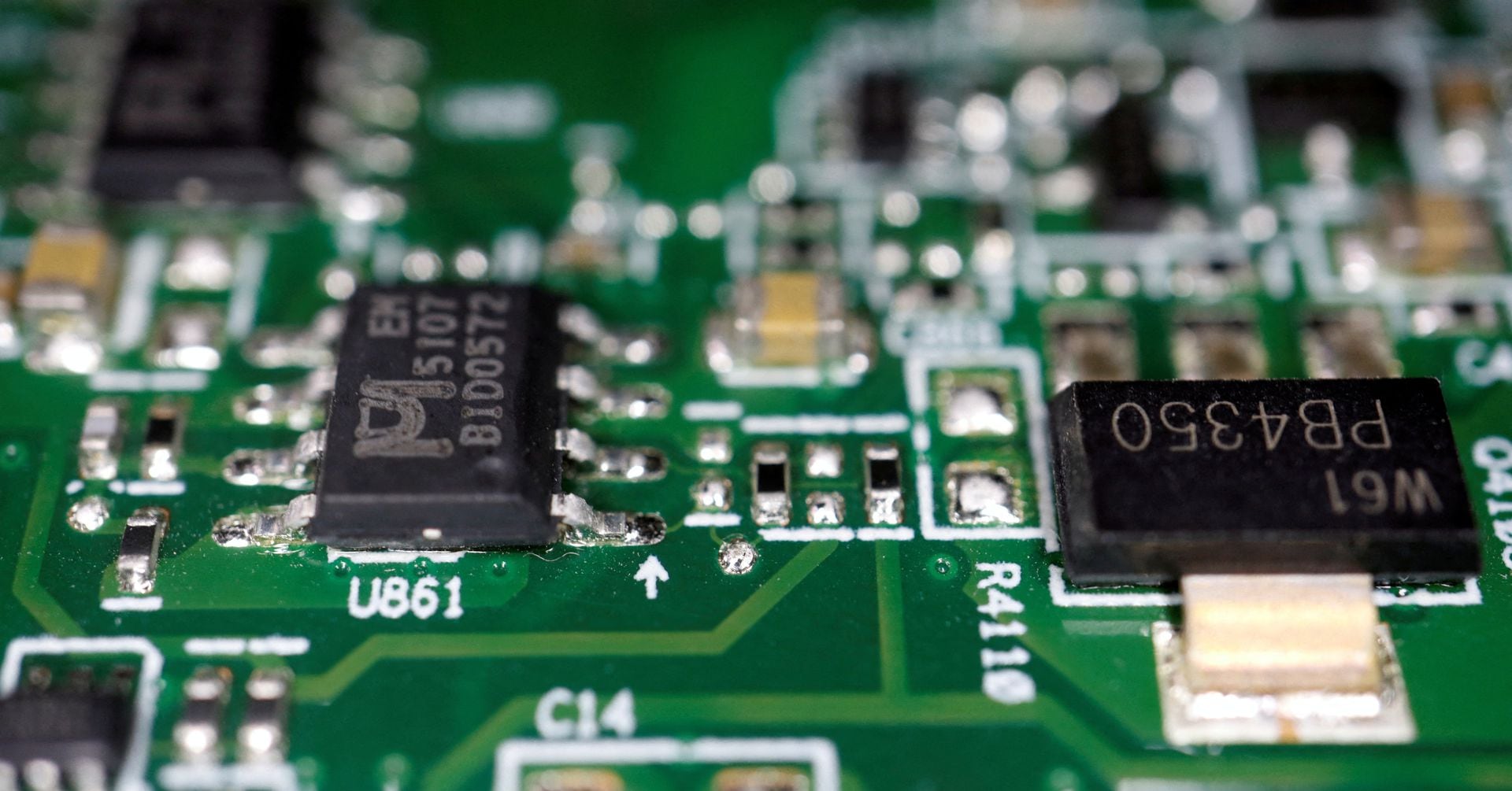

The positive momentum in global stocks waned as Asian shares turned lower following a chip selloff triggered by underwhelming revenue forecasts from Intel, causing a ripple effect in the semiconductor sector. Policy-driven undercurrents, such as the Bank of Japan's hawkish tilt and state-backed stock buying in China, also influenced the market. With a light European data calendar, attention turns to upcoming earnings reports from U.S. tech giants and key events including a Federal Reserve meeting and the monthly jobs report, while the MSCI world index still looks set for a third straight weekly gain despite Asia's disappointing start.

Topics:business#asian-shares#earnings-reports#finance#global-markets#semiconductor-chips#stock-market

- Morning Bid: Chip selloff short-circuits equity cheer Reuters

- Dow Jones Futures Fall As Intel Tumbles Late; Tesla Triggers Bearish Signals Investor's Business Daily

- Stocks to Watch Friday: Intel, LVMH, Visa The Wall Street Journal

- Marketmind: Chip selloff short-circuits equity cheer Yahoo Finance

- Biggest stock movers today: Intel, Visa, and more (NASDAQ:INTC) Seeking Alpha

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

77%

433 → 98 words

Want the full story? Read the original article

Read on Reuters