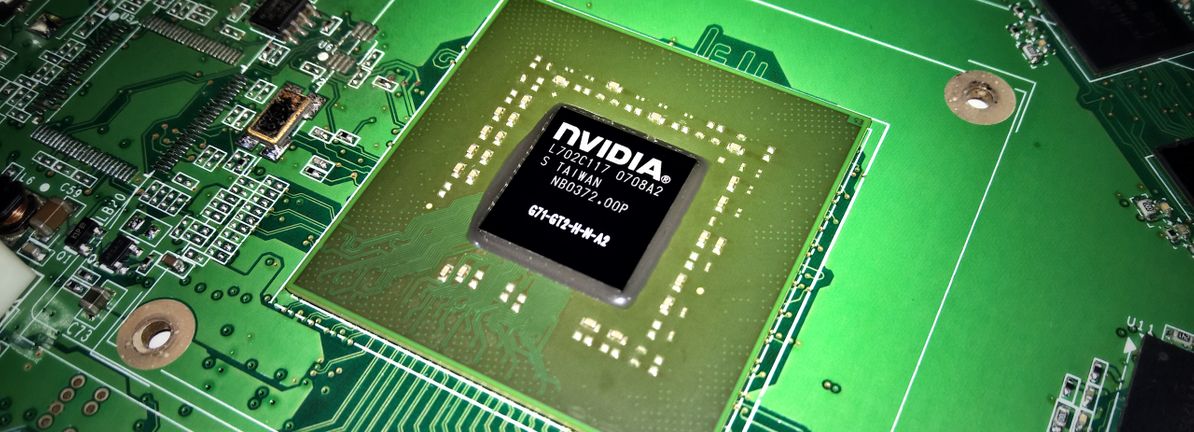

Nvidia's Earnings Growth Lags Behind Shareholder Returns Despite Recent Jump in Stock Price

TL;DR Summary

NVIDIA's share price has increased by 564% in the last five years, with a 66% increase in the past quarter. However, earnings growth has only been 4.3% per year over the same period, suggesting that market participants hold the company in higher regard. NVIDIA has a total shareholder return of 570% for the last five years, including dividends. While there are some weaknesses, there are no apparent threats visible for the company.

- NVIDIA (NASDAQ:NVDA) jumps 11% this week, though earnings growth is still tracking behind five-year shareholder returns Simply Wall St

- Nvidia Insiders Continue To Sell Shares After Hitting All-Time Highs, $1 Trillion Market Cap: What Invest Benzinga

- Bank of America says keep buying Nvidia shares for two main reasons CNBC

- Nvidia Stock Higher As Morgan Stanley Names AI Chipmaker 'Top Pick' Over AMD TheStreet

- Missed Out on Nvidia's Surge? Wall Street Thinks This AI Stock Could Skyrocket 58% The Motley Fool

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

4 min

vs 5 min read

Condensed

91%

813 → 72 words

Want the full story? Read the original article

Read on Simply Wall St