Navigating the 2024 Stock Market: Insights and Projections

TL;DR Summary

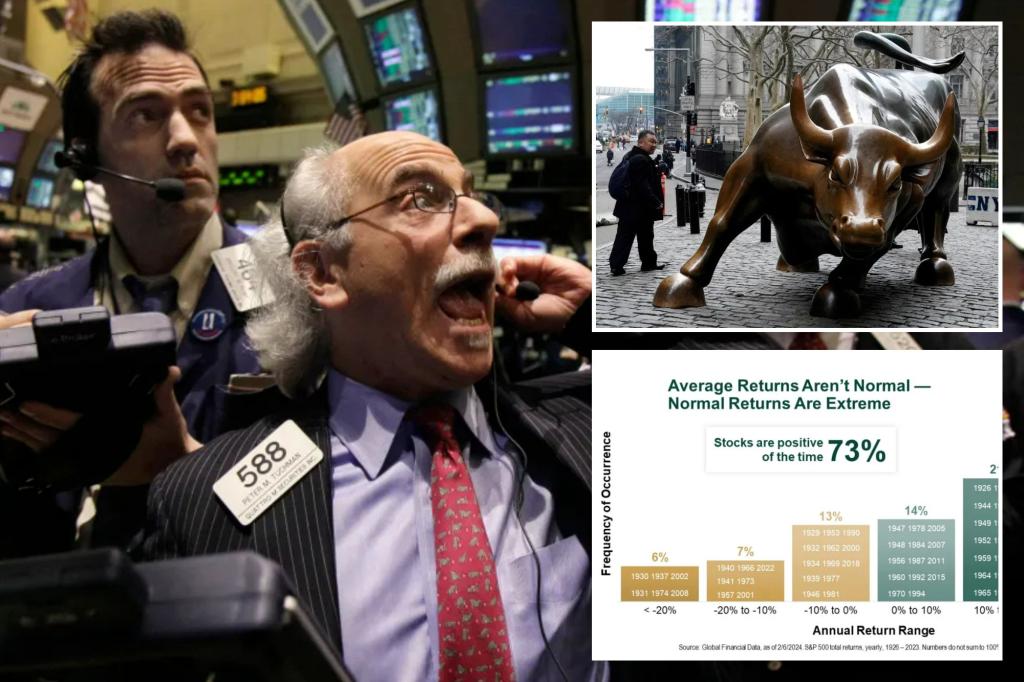

Despite concerns of an overheated market, historical data spanning nearly a century suggests that above-average returns and positive volatility are more common than perceived in the stock market. With statistics showing that stocks rise far more often than they fall, and no rolling 20-year period of negative returns in 98 years, the fear of "too far, too fast" gains may be unwarranted. Ken Fisher, founder of Fisher Investments, emphasizes that big returns are more normal than not in bull markets, and investors should not be acrophobic when it comes to investing.

- Why investors are grappling with a 'fear of heights' in 2024 -- and what 98 years of history tells us New York Post

- The stock market is crushing the first quarter. What that may mean for 2024. MarketWatch

- Stock Market Outlook: 13% Gains Coming Over Next Year, Research Firm Says Markets Insider

- Updated 2024 Stock Market Outlook Entrepreneur

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

3 min

vs 4 min read

Condensed

85%

610 → 91 words

Want the full story? Read the original article

Read on New York Post