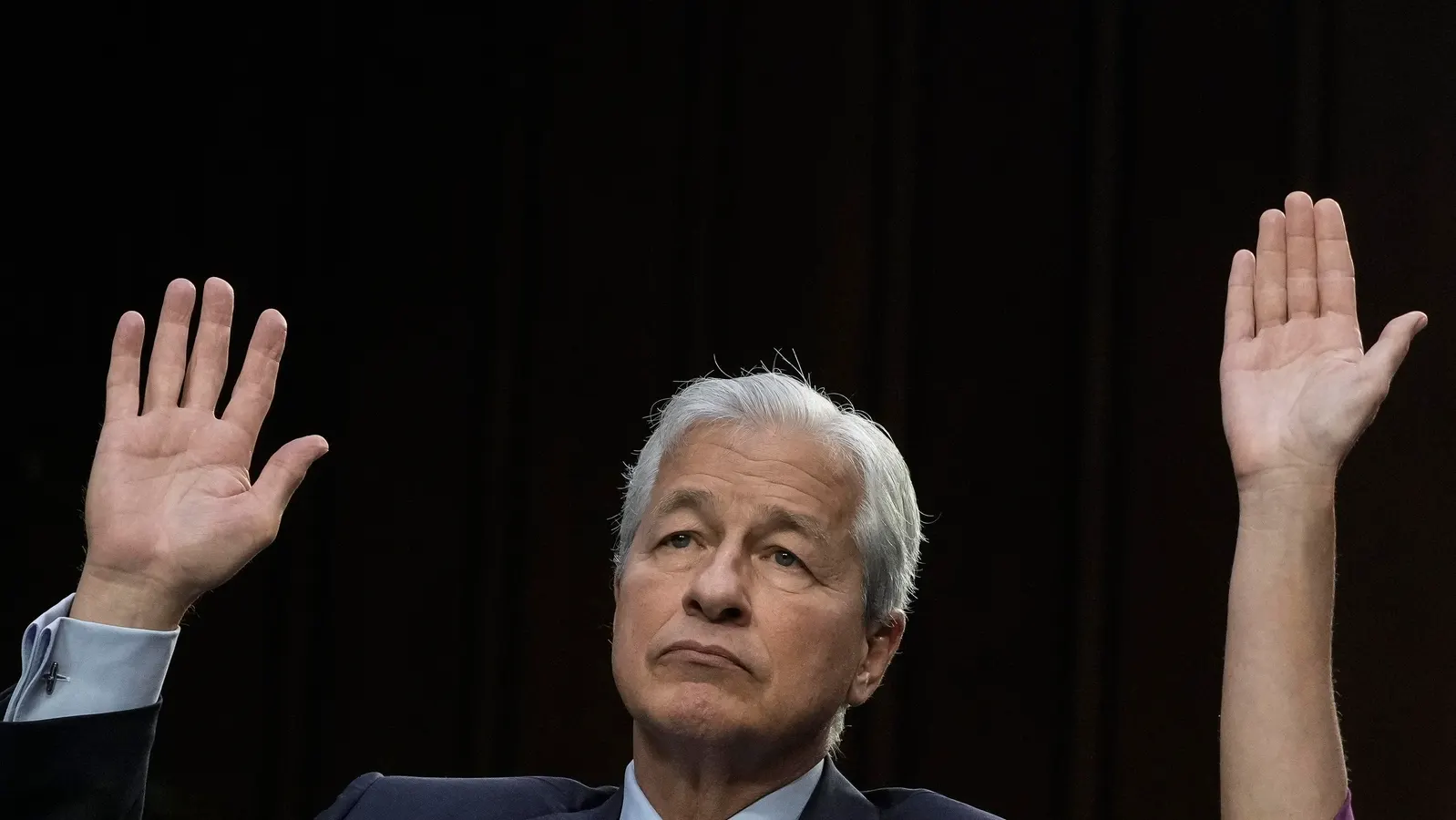

Jamie Dimon Warns of Bond Market Risks Amid US Debt Concerns

TL;DR Summary

JPMorgan CEO Jamie Dimon warns of a potential bond market crack due to high debt levels and rising yields, which could lead to sharp bond price declines and liquidity issues. While some economic indicators suggest resilience, investors are advised to hedge by shifting to short-term bonds and stocks in sectors benefiting from higher interest rates.

- JPMorgan’s Jamie Dimon Sees Bond Market Crack — Why And What To Do Forbes

- Jamie Dimon warns US debt and deficits are a growing problem Fox Business

- Jamie Dimon’s bond-market warnings put investors on alert to diversify outside U.S. MarketWatch

- Finance leaders fear destructive U.S. debt scenario Axios

- JPMorgan CEO Dimon backs US taxing carried interest, warns of bond market trouble Reuters

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

6 min

vs 7 min read

Condensed

96%

1,269 → 55 words

Want the full story? Read the original article

Read on Forbes