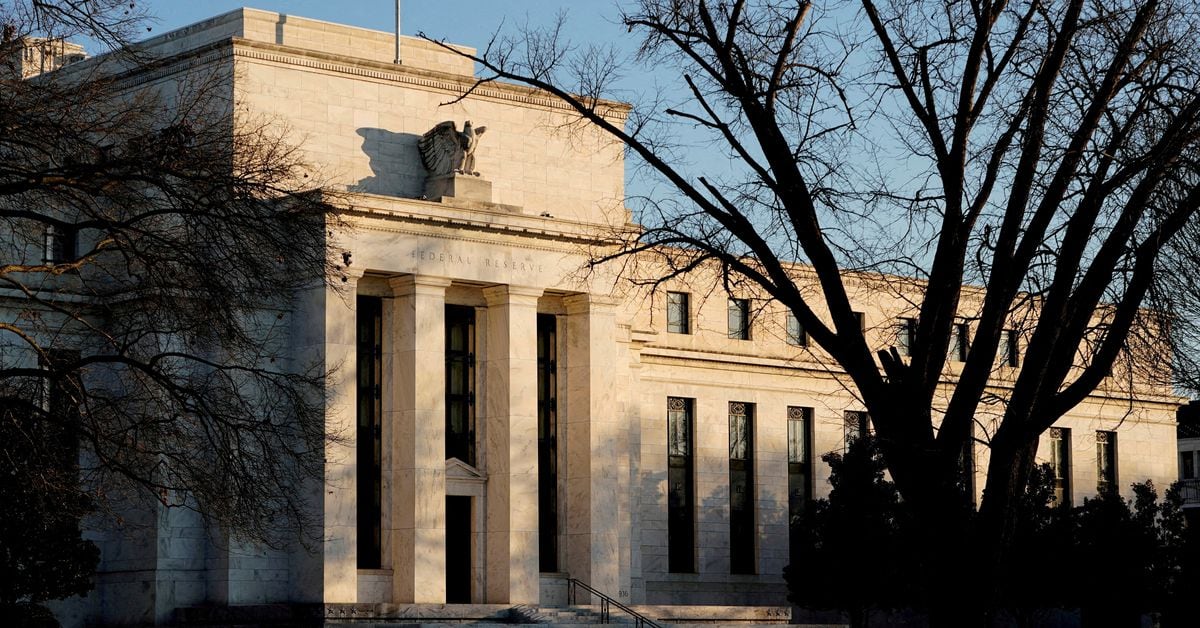

$6 Trillion Cash Hoard Set to Boost U.S. Stock Gains Amid Fed's Pivot

TL;DR Summary

A nearly $6 trillion cash hoard sitting on the sidelines could potentially fuel further gains in U.S. stocks as the Federal Reserve shifts its stance. Soaring yields have attracted cash into money market funds, but the Fed's recent dovish pivot may prompt investors to deploy cash into riskier assets like stocks. Historically, cash has returned an average of 4.5% following the last rate hike, while U.S. equities have surged by 24.3%. However, not all the cash in money market funds may be available for investment, and the size of money market assets relative to the stock market is smaller than in previous peaks.

- A $6 trillion cash hoard could fuel more U.S. stock gains as Fed pivots Reuters

- A $6 trillion cash hoard could fuel more stock gains as Fed pivots Yahoo Finance

- Nearly $6 trillion is sitting in money market funds. Here's where that cash can go next CNBC

- Money-Market Fund Assets Pull Back for First Time Since October Bloomberg

- Fed Action Could Put Idle Cash Back to Work etf.com

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

3 min

vs 4 min read

Condensed

86%

717 → 103 words

Want the full story? Read the original article

Read on Reuters