Bitcoin ETFs Surge: BlackRock and Fidelity Lead the Way

TL;DR Summary

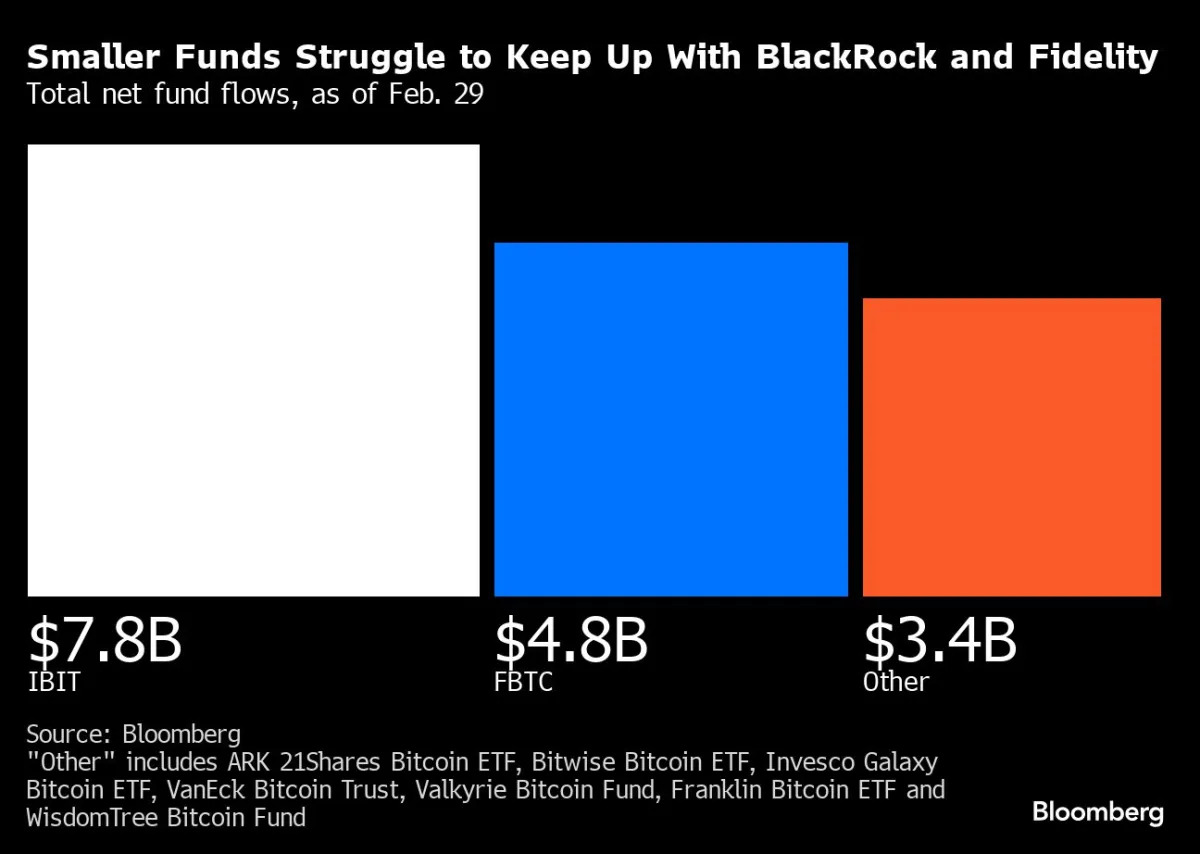

BlackRock Inc.'s iShares Bitcoin Trust (IBIT) and Fidelity Investments’ Wise Origin Bitcoin Fund (FBTC) have captured 79% of total inflows into the “Newborn Nine” Bitcoin ETFs since the US SEC approved the assets in January. With Bitcoin's surge, retail investors are flocking to these new ETFs, prompting fee cuts from other funds to compete. Grayscale's Bitcoin trust, now an ETF, has seen outflows, while BlackRock's IBIT fund is pulling ahead of Fidelity to dominate the sector, with BlackRock winning $612 million of new investment on Feb. 28.

- BlackRock and Fidelity Capitalize on FOMO From Bitcoin ETF Mania Yahoo Finance

- Bitcoin ETFs hit record volume as single-day high of $612 million pours into BlackRock Fortune

- 'Bigger Wave Coming'—Bitcoin Now Braced For Its 'IPO Moment' After Huge $2.3 Trillion Ethereum, XRP And Crypto Price Surge Forbes

- Bitcoin ETFs now hold nearly 4% of all bitcoin — and they're not slowing down Blockworks

- Bitcoin ETF Boom Is the Cryptocurrency's 'IPO Moment': Fund Provider Markets Insider

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

85%

582 → 87 words

Want the full story? Read the original article

Read on Yahoo Finance