"Bank of America's Fourth-Quarter Earnings: Profit Decline and Stock Slide"

TL;DR Summary

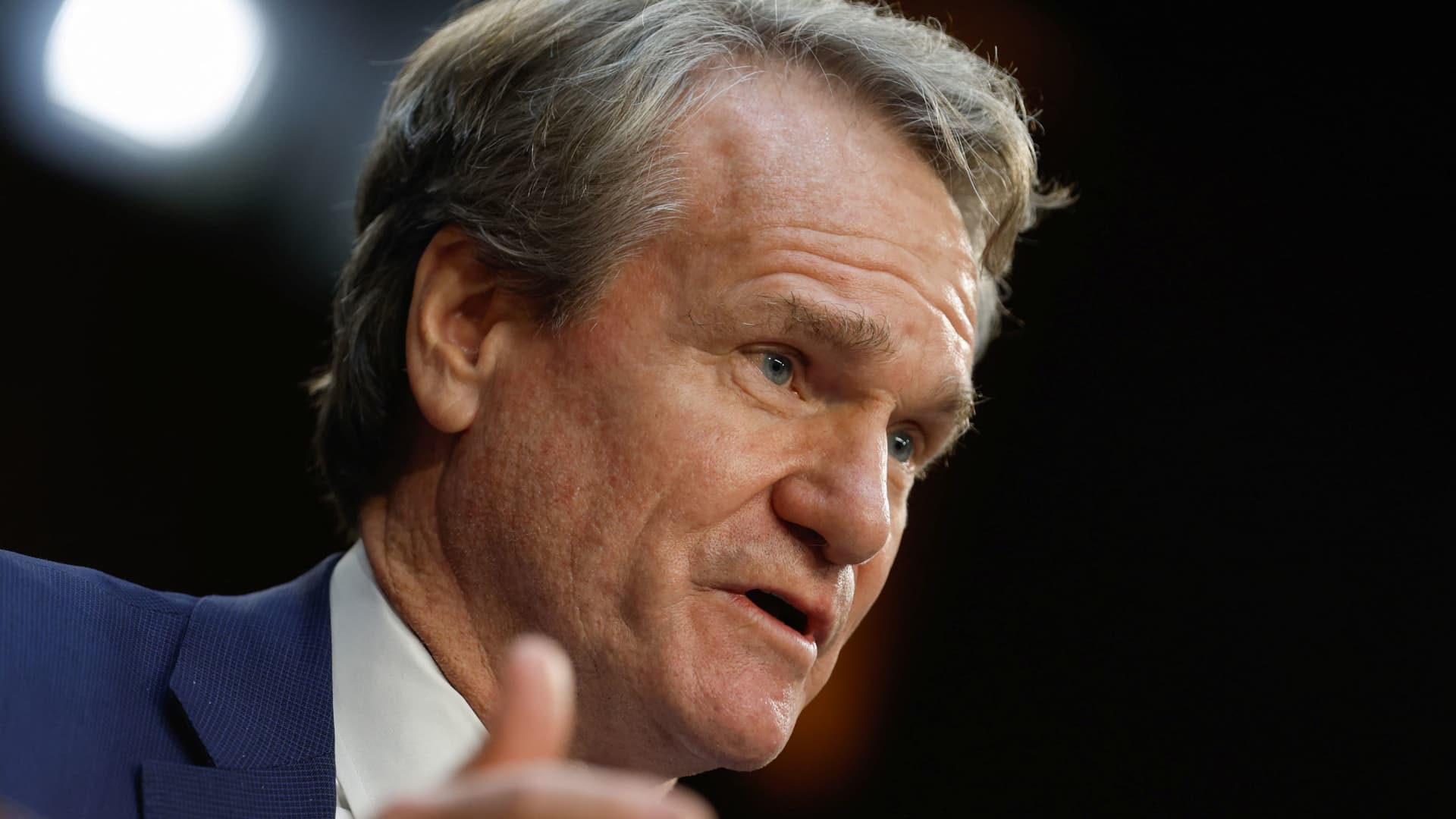

Bank of America's shares fell over 2% in premarket trading after reporting a more than 50% decline in fourth-quarter net income to $3.1 billion, with earnings per share at 70 cents compared to the expected 68 cents. The bank attributed the decrease to higher deposit costs and lower deposit balances affecting net interest income, despite CEO Brian Moynihan noting strong organic growth and record client activity. Bank of America's stock has seen a 1% decline this year following a modest 1.7% gain in 2023, underperforming its peers due to investments in low-yielding securities during the Covid pandemic.

Topics:business#bank-of-america#brian-moynihan#finance#fourth-quarter-earnings#interest-rates#stock-market

- Bank of America shares fall after company reports lower fourth-quarter profit, hit by regulatory charge CNBC

- BofA's Earnings Report Will Wrap Up a Tough Year Barron's

- Bank of America profit falls Reuters

- Bank of America’s stock slides 3% premarket after revenue miss offsets better-than-expected profit MarketWatch

- Bank of America Non-GAAP EPS of $0.70 beats by $0.06, revenue of $21.96B misses by $1.77B Seeking Alpha

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

64%

270 → 97 words

Want the full story? Read the original article

Read on CNBC