Natural Gas Futures Surge on Bullish Storage Data and Rising Costs for Producers

TL;DR Summary

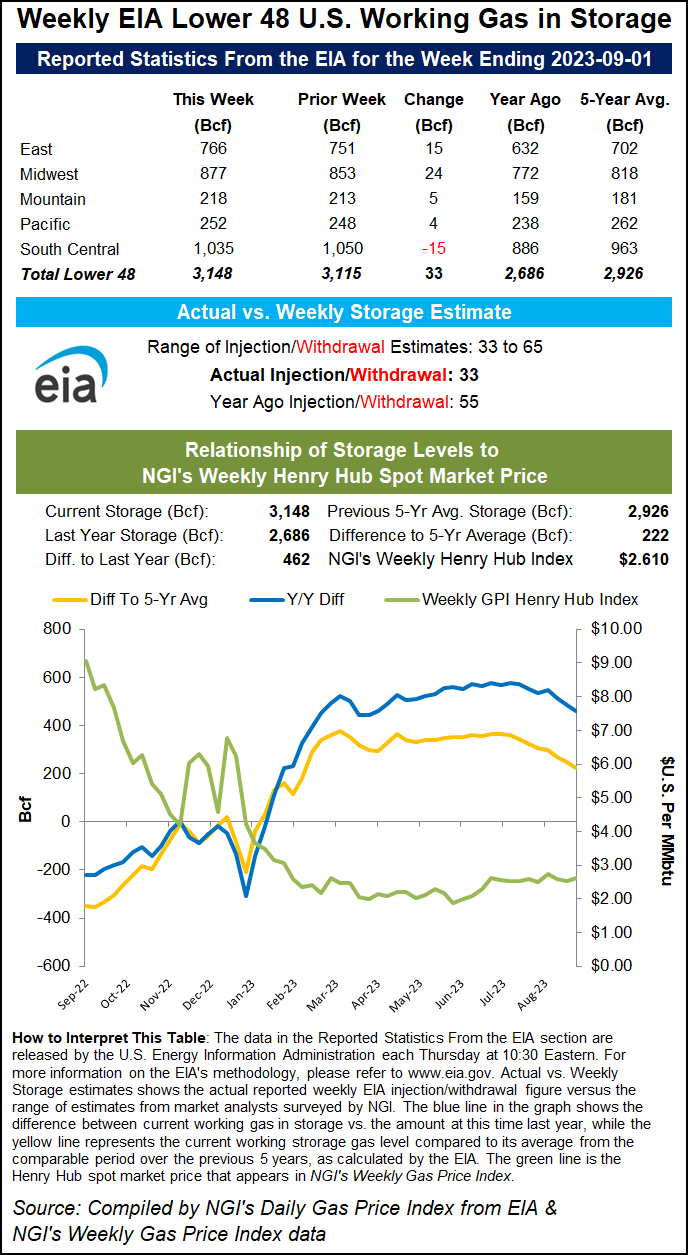

The U.S. Energy Information Administration (EIA) reported a smaller-than-expected injection of 33 Bcf natural gas into storage for the week ended Sept. 1, causing a rally in Nymex natural gas futures. Prior to the report, market expectations ranged from 33 Bcf to 65 Bcf, with a median estimate of 42 Bcf. The October futures contract initially rose to $2.600/MMBtu before settling at $2.590/MMBtu, up 8.0 cents.

Topics:business#eia#energy#market-expectations#natural-gas-futures#natural-gas-storage#price-increase

- October Natural Gas Futures Rally Following Bullish Storage Print Natural Gas Intelligence

- Analysts Expect 42 Billion-Cubic-Foot Rise in U.S. Natural-Gas Inventories The Wall Street Journal

- Natural Gas Futures: Extra decline not ruled out FXStreet

- Natural Gas Producers Seeing Rising Costs, but 75% of Reserves Economic at $4/Mcfe, Study Finds Natural Gas Intelligence

- Natural gas price fluctuates above the support – Analysis – 7-9-2023 Economies.com

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

10

Time Saved

1 min

vs 2 min read

Condensed

79%

314 → 66 words

Want the full story? Read the original article

Read on Natural Gas Intelligence