Bitcoin's Rollercoaster Ride: Fed Nightmare, Post-Fed Losses, Surprising Winners, Alameda Claims, and Squeeze Incoming

TL;DR Summary

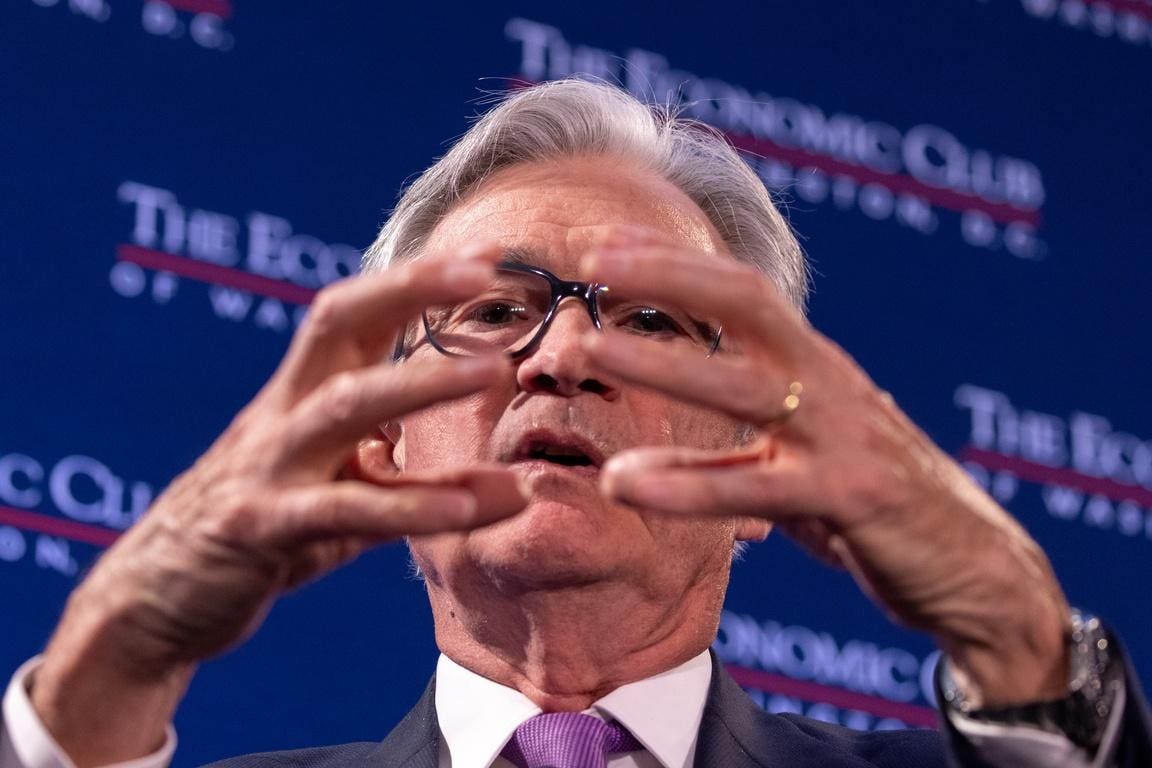

Bitcoin and crypto companies are facing a "nightmare" scenario as the Federal Reserve signals that interest rates will remain higher for longer. The Fed's decision to hold interest rates at their highest in over 20 years has raised concerns about elevated borrowing costs and refinancing difficulties for crypto firms. The looming historical halving event for Bitcoin, combined with the possibility of a U.S. government shutdown, could further contribute to market volatility. Analysts warn that without Fed easing, both equities and Bitcoin prices may be negatively impacted.

Topics:business#bitcoin#crypto-companies#cryptocurrency#federal-reserve#interest-rates#market-volatility

- Bitcoin’s Fed ‘Nightmare’ Is Suddenly Coming True Forbes

- Bitcoin fails to recoup post-Fed losses as $20K BTC price returns to radar Cointelegraph

- Bitcoin Failed at $27K but There’s a Surprising Winner This Week (Market Update) CryptoPotato

- Bitcoin’s 87% Drop in 2021 Was Caused by Sam Bankman-Fried's Alameda, Ex-Employee Claims CoinDesk

- Binance & Deribit Traders Aggressively Short Bitcoin, Squeeze Incoming? NewsBTC

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

3 min

vs 3 min read

Condensed

86%

597 → 86 words

Want the full story? Read the original article

Read on Forbes