The Grim Reality of a Debt-Fueled M&A Boom

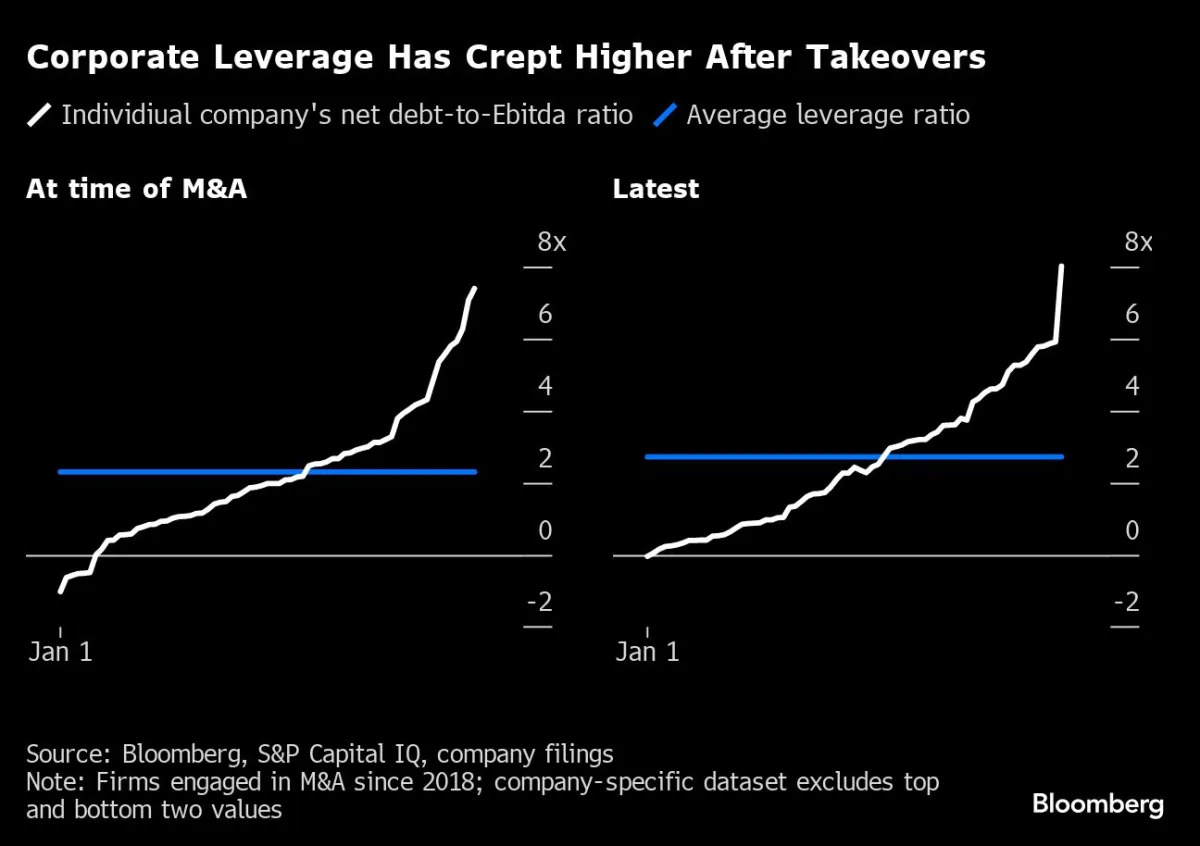

Companies that relied on cheap credit to fund large mergers and acquisitions (M&A) during the boom times are now facing challenges in delivering on their promises and servicing their debt loads in a new environment of higher interest rates and weakening consumer demand. An analysis of 75 of the largest corporate acquisitions over the past five years, totaling nearly $1.3 trillion, reveals that less than half of the companies have managed to reduce leverage ratios since their acquisitions. Almost a third of the firms now have leverage ratios above 3.5, compared to 16 at the time of the acquisitions. The need to refinance debt and deliver on synergies or earnings growth is becoming a concern, especially as cash buffers erode, sales decline, and the risk of recession looms. Companies such as Walgreens, Rogers Communications, and International Flavors & Fragrances have seen their creditworthiness slide, while others, like Warner Bros. Discovery and SAP, continue to seek smaller bolt-on acquisitions. However, caution is advised as higher interest rates may lead to downgrades and mistakes in dealmaking.

- A $1.3 Trillion Debt-Fueled Boom in Deals Faces a Grim New Reality Yahoo Finance

- A $1.3 Trillion Debt-Fueled M&A Boom Faces High-Interest Rate Realities Bloomberg

- Credit Boom's End Disrupts Corporate Finance BNN Breaking

- Debt-Fueled Dealings Come Unstuck Amid Higher Interest Rates Bloomberg

- The Debt-Fueled M&A Boom Struggles With a Tough New Reality Bloomberg

Reading Insights

0

7

11 min

vs 12 min read

93%

2,365 → 174 words

Want the full story? Read the original article

Read on Yahoo Finance