FDIC Finds Buyer for Signature Bank Operations.

New York Community Bank's acquisition of loans from Signature Bank did not include the latter's $19.5bn multifamily loan book, which primarily covers the troubled rent-stabilized sector. The move could signal problems with those loans or simply that NYCB did not want to be overweighted in that area. The majority of Signature's multifamily lending was to rent-stabilized properties, which have seen values sink between 20 to 65 percent since a 2019 state law severely limited rent increases. The delayed sale of the loans does not bode well for potential buyers' perception of the multifamily loan book, and for stabilized borrowers facing distress, NYCB's pass on Signature's commercial real estate portfolio could spell tougher times ahead.

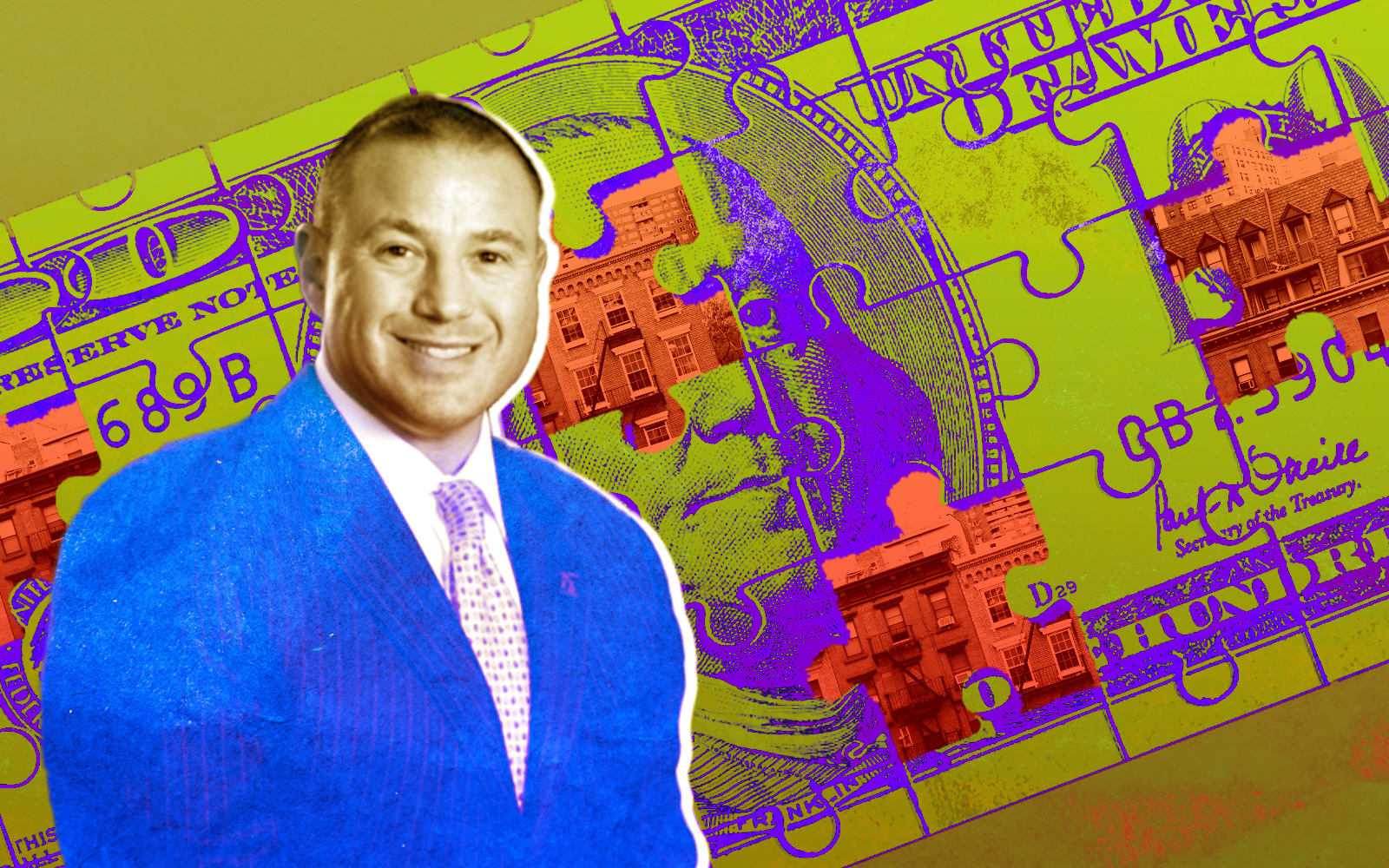

- New York Community Bank Snubs Signature Bank's CRE Loans The Real Deal

- Opinion | Barney Frank Was Right About Signature Bank The Wall Street Journal

- Signature Bank operations have buyer, FDIC says ABC News

- A refresher on what the FDIC is and does Houston Public Media

- Where does Wall Street and tech go after SVB's downfall? Business Insider

Reading Insights

0

0

3 min

vs 4 min read

85%

754 → 114 words

Want the full story? Read the original article

Read on The Real Deal