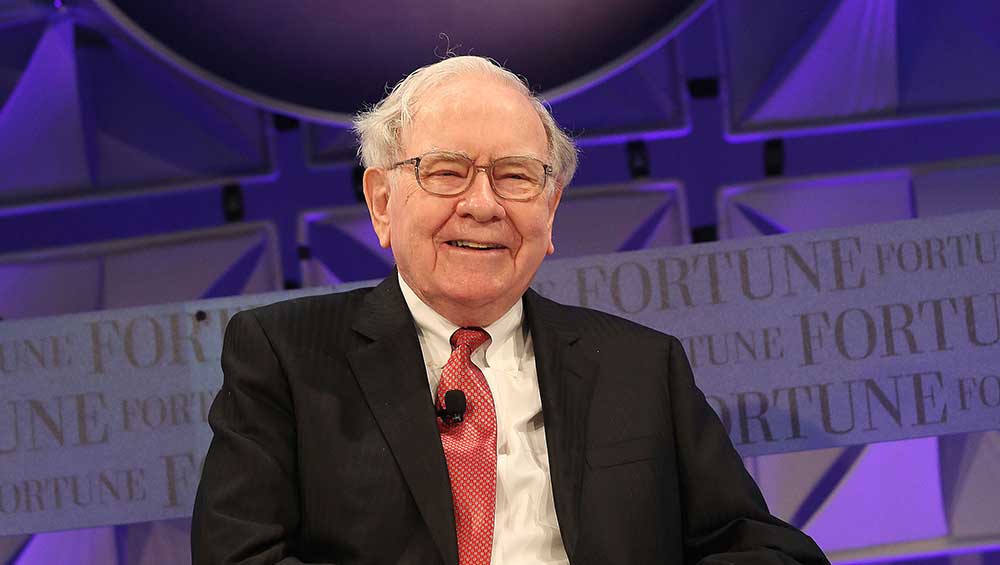

Warren Buffett's Secret Stock: AI Reveals Clues and Upcoming Reveal

Warren Buffett's Berkshire Hathaway is building a significant, confidential stake in a major industrial stock, with WarrenAI suggesting Caterpillar as the most fitting choice based on Buffett's investment style, while Deere & Company is also considered a strong contender depending on revenue stability.