"Comparing Lifetime Tax Burdens Across US States"

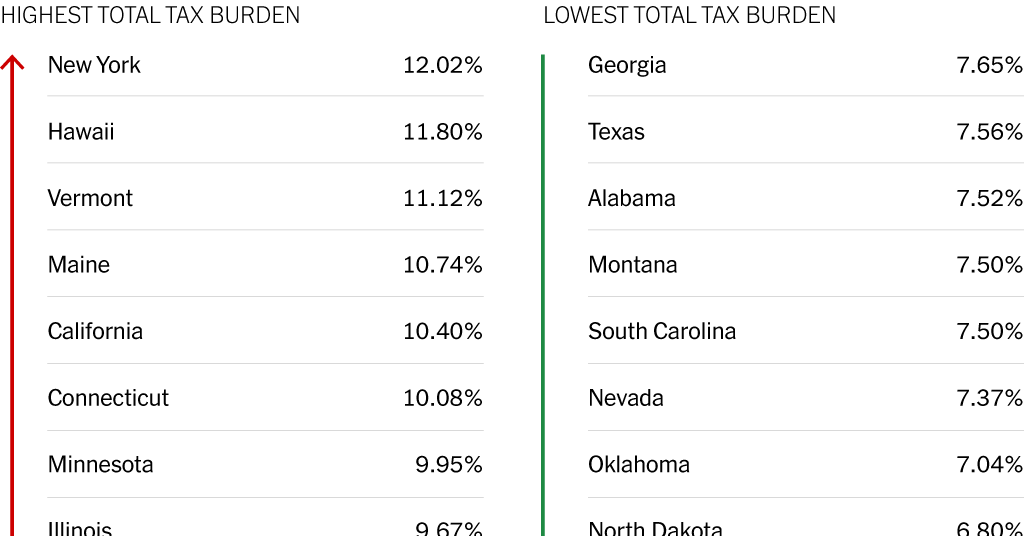

As Tax Day approaches in the US, a study by WalletHub has ranked the 50 states by their total tax burden, which includes individual income taxes, property taxes, and sales and excise taxes. New York State has the highest tax burden, over 12 percent, followed by Hawaii, Vermont, Maine, and California. On the other end, Alaska has the lowest tax burden at less than 5 percent. Maine, Vermont, and New Jersey were found to have the highest property taxes, while Washington, Nevada, and Hawaii had the highest combined sales and excise taxes.