"Comparing Lifetime Tax Burdens Across US States"

TL;DR Summary

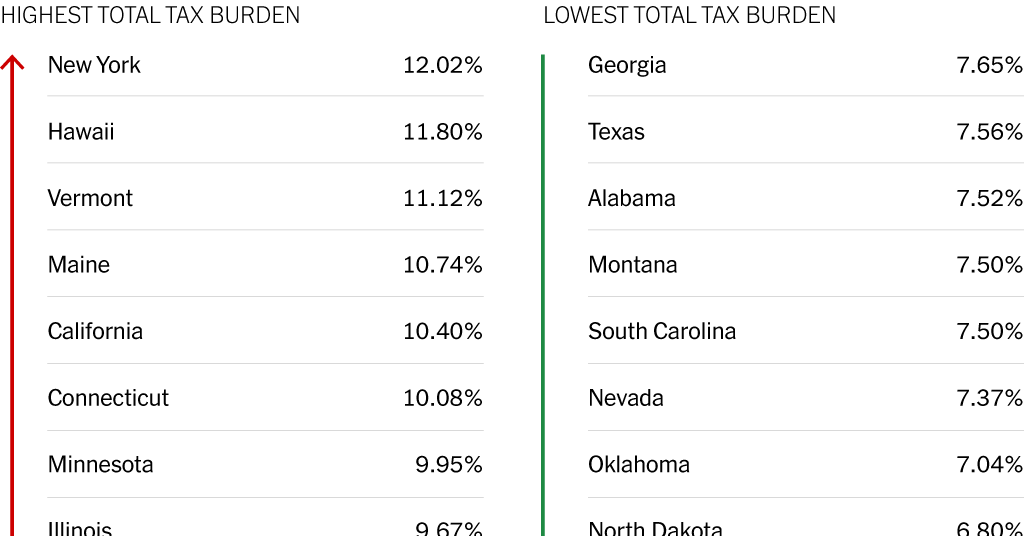

As Tax Day approaches in the US, a study by WalletHub has ranked the 50 states by their total tax burden, which includes individual income taxes, property taxes, and sales and excise taxes. New York State has the highest tax burden, over 12 percent, followed by Hawaii, Vermont, Maine, and California. On the other end, Alaska has the lowest tax burden at less than 5 percent. Maine, Vermont, and New Jersey were found to have the highest property taxes, while Washington, Nevada, and Hawaii had the highest combined sales and excise taxes.

Topics:nation#property-taxes#real-estate#sales-and-excise-taxes#state-tax-burden#taxes#wallethub-study

- Do You Wish You Lived in a Low-Tax State? The New York Times

- Which states cost the most in lifetime taxes? USA TODAY

- The states where high-income earners pay the most and least in taxes Business Insider

- Here's how much Americans pay in taxes over their lifetime. And what you pay in DC, Maryland & Virginia FOX 5 DC

- How much the average Michigander will pay in taxes over a lifetime 9 & 10 News

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

66%

273 → 92 words

Want the full story? Read the original article

Read on The New York Times