Blackstone and TPG Announce $18.3 Billion Deal to Take Hologic Private

Blackstone and TPG are collaborating on an $18.3 billion deal to take Hologic private, marking a significant move in the private equity landscape.

All articles tagged with #tpg

Blackstone and TPG are collaborating on an $18.3 billion deal to take Hologic private, marking a significant move in the private equity landscape.

Blackstone and TPG are set to acquire Hologic for up to $18.3 billion, including debt, at a 15% premium, with minority stakes taken by Abu Dhabi Investment Authority and GIC, highlighting active private equity dealmaking in the healthcare sector.

Hologic is set to be acquired by Blackstone and TPG for up to $79 per share, including a $76 cash payment and a contingent value right of up to $3 per share, in a deal valued at approximately $18.3 billion, aimed at strengthening its leadership in women's health and accelerating growth.

Blackstone and TPG are in advanced negotiations to acquire Hologic for over $17 billion, with a potential deal announcement soon, though the final agreement is not yet confirmed.

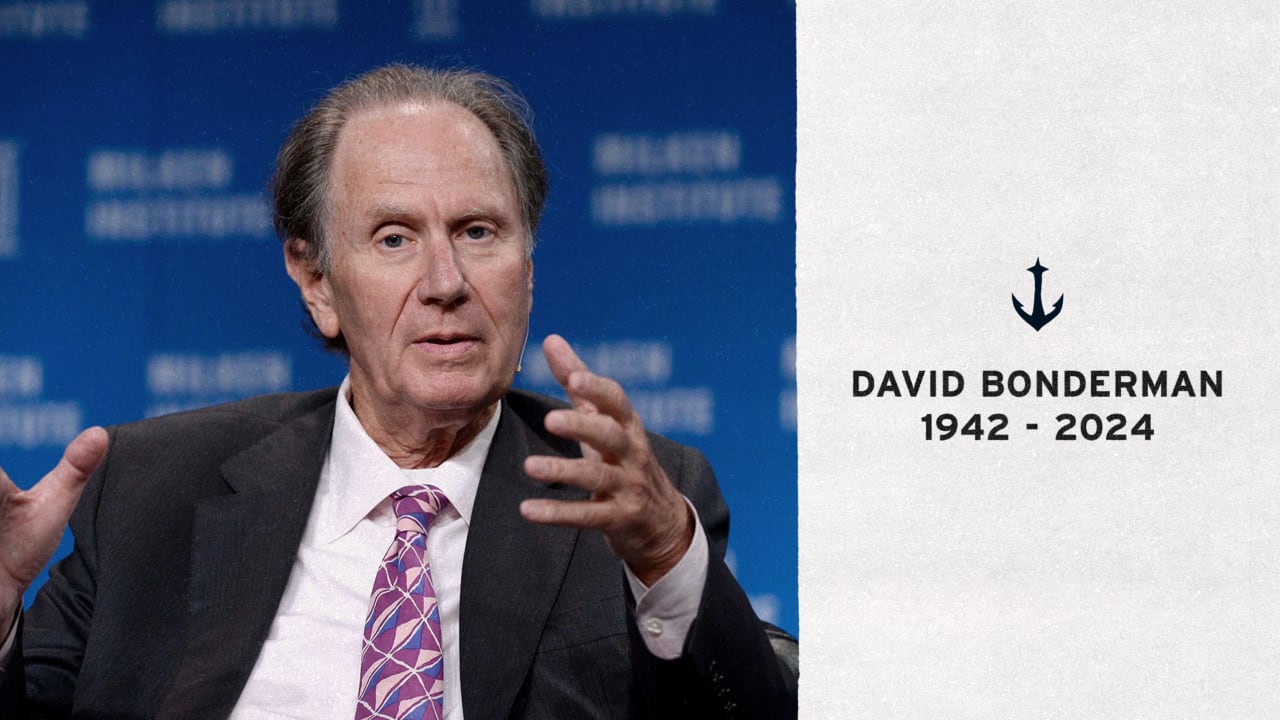

David Bonderman, co-founder and co-majority owner of the Seattle Kraken, passed away at 82. Bonderman, who also co-founded TPG, was instrumental in bringing NHL hockey to Seattle, leading to the creation of the Kraken. His daughter, Samantha Holloway, will continue his legacy as co-owner. Bonderman was also a minority owner of the Boston Celtics and had a deep connection to Seattle, having worked as a security guard at the Space Needle and supported the University of Washington through the Bonderman Fellowship.

David Bonderman, co-founder of asset management firm TPG and a key figure in bringing professional hockey to Seattle with the Kraken, has died at 82. Known for his low public profile and successful corporate investments, Bonderman was estimated to be worth $6.5 billion. He was involved in several high-profile investments, including Airbnb and Spotify, and served on various corporate boards. Bonderman was also known for his political support and lavish birthday celebrations. He is survived by five children and three grandchildren.

David Bonderman, co-founder of Texas Pacific Group (TPG) and a pioneer in private equity, has died at 82. Known for his role in the buyout of Continental Airlines, Bonderman was a key figure in high-stakes corporate takeovers. Before entering finance, he had a notable legal career, including a landmark Supreme Court case on insider trading. Bonderman was also a prominent conservationist and sports investor, contributing to wildlife preservation and owning stakes in the Boston Celtics and Seattle Kraken. TPG praised him as a legal scholar and global citizen.

David Bonderman, co-founder of TPG and owner of the Seattle Kraken, passed away at 82. Known for his innovative approach in private equity, Bonderman was instrumental in transforming TPG into a global asset manager. He was also a passionate advocate for environmental conservation and education, serving on numerous boards. Bonderman's legacy includes his contributions to business, sports, and philanthropy, as well as his devotion to family.

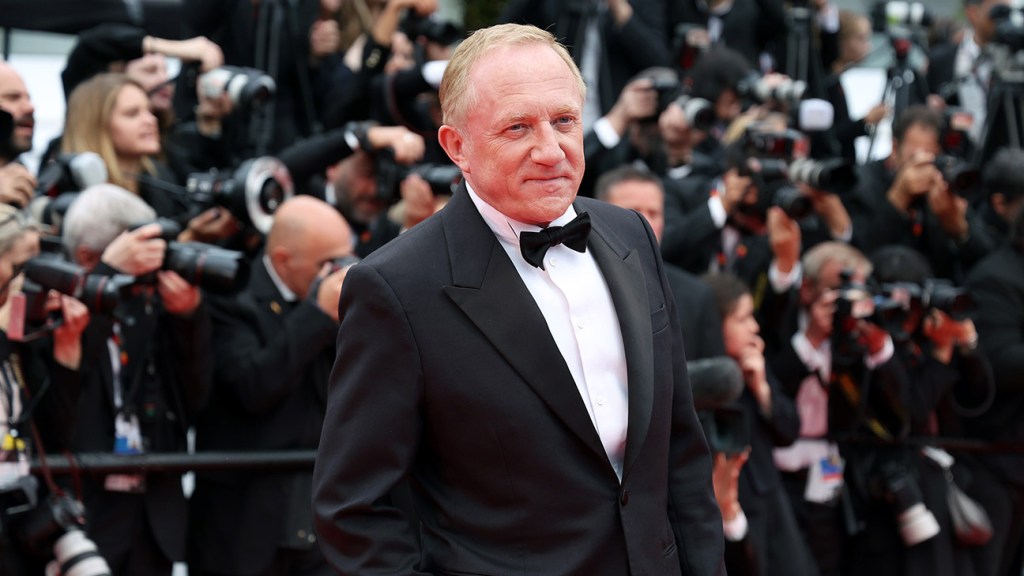

Talent agency giant CAA has sold a majority stake to Artémis, the investment firm controlled by François-Henri Pinault, CEO of fashion firm Kering. CAA's leadership team will remain in place, with Bryan Lourd expected to be named CEO. The terms of the deal were not disclosed, but CAA's previous owner TPG sought a valuation of about $7 billion. The sale marks the biggest acquisition in Hollywood's representation space since 2013 and brings CAA closer to the luxury space where Pinault has a large presence.

EY, one of the Big Four accounting firms, has rejected a proposal by private equity firm TPG to break up the company. TPG's plan aimed to separate EY's audit and consulting businesses, but EY deemed the proposal not in the best interest of its clients and stakeholders.

Software firm New Relic has agreed to be taken private by private equity firms TPG and Francisco Partners in a $6.5 billion all-cash deal. The move comes as New Relic faces competition in the application performance monitoring space from companies like Datadog and Dynatrace. The deal offers New Relic shareholders $87 per share, representing a 15% premium to the stock's closing price on May 16. New Relic's cloud-based software helps monitor servers, databases, and user interactions, boosting efficiency for businesses. The company reported first-quarter revenue of $242.6 million, beating analysts' estimates. New Relic has a 45-day window to seek other acquisition proposals.

Francisco Partners and TPG, in a consortium, will acquire software provider New Relic in an all-cash deal worth nearly $6.5 billion. The offer of $87 per share represents a 26% premium to New Relic's average closing price. The deal is expected to close by early 2024 and will return New Relic to private ownership after nearly nine years on the stock exchange. Major shareholders have approved the deal, and New Relic will have a 45-day "go-shop" period to consider other offers. Francisco Partners and TPG have secured financing to meet New Relic's desired valuation.

Private-equity firm TPG is set to acquire the government cybersecurity business unit of software provider Forcepoint for $2.45 billion, more than double the price paid by Francisco Partners when they purchased Forcepoint in 2021.

Private equity firms Francisco Partners and TPG have ended talks to acquire New Relic after they failed to secure enough debt financing and could not meet the business software company's valuation expectations. The demise of the deal negotiations underscores the challenges facing private equity firms seeking to put together leveraged buyouts. New Relic has been negotiating with potential acquirers since last year, and it's possible that deal talks resume some time in the future.

TPG is acquiring Angelo Gordon, an investment firm focused on credit and real estate markets, for $2.7 billion. The acquisition will include approximately $970 million in cash and up to 62.5 million units of the TPG Operating Group and restricted stock units of TPG. The move brings TPG CEO Jon Winkelreid back into the credit investing world, something the firm moved away from in 2020 after it split from Sixth Street. Angelo Gordon will be that way back in.