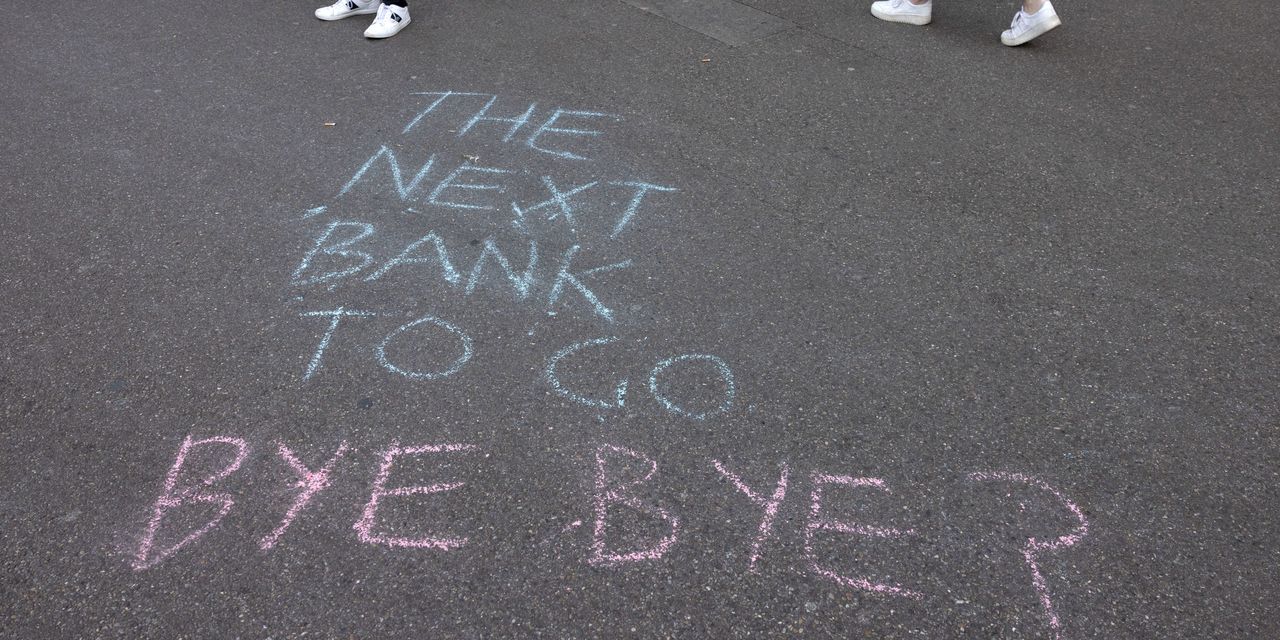

Fund Managers' Top Fear: Systemic Credit Event and Missing the Next Rally.

Fund managers fear a systemic credit crunch as the biggest tail risk this month, according to Bank of America's latest global fund manager survey. The most likely sources of a credit event are U.S. shadow banking, U.S. corporate debt, and developed-market real estate. Investors see an additional 75 basis points of Federal Reserve rate hikes in this cycle with rates peaking at 5.25%-5.5%. Over four in 10 fund managers say a recession is headed in the next 12 months. The survey also found fund managers are more bullish on Eurozone stocks than U.S. stock, the most overweight they have been on Europe since October 2017.