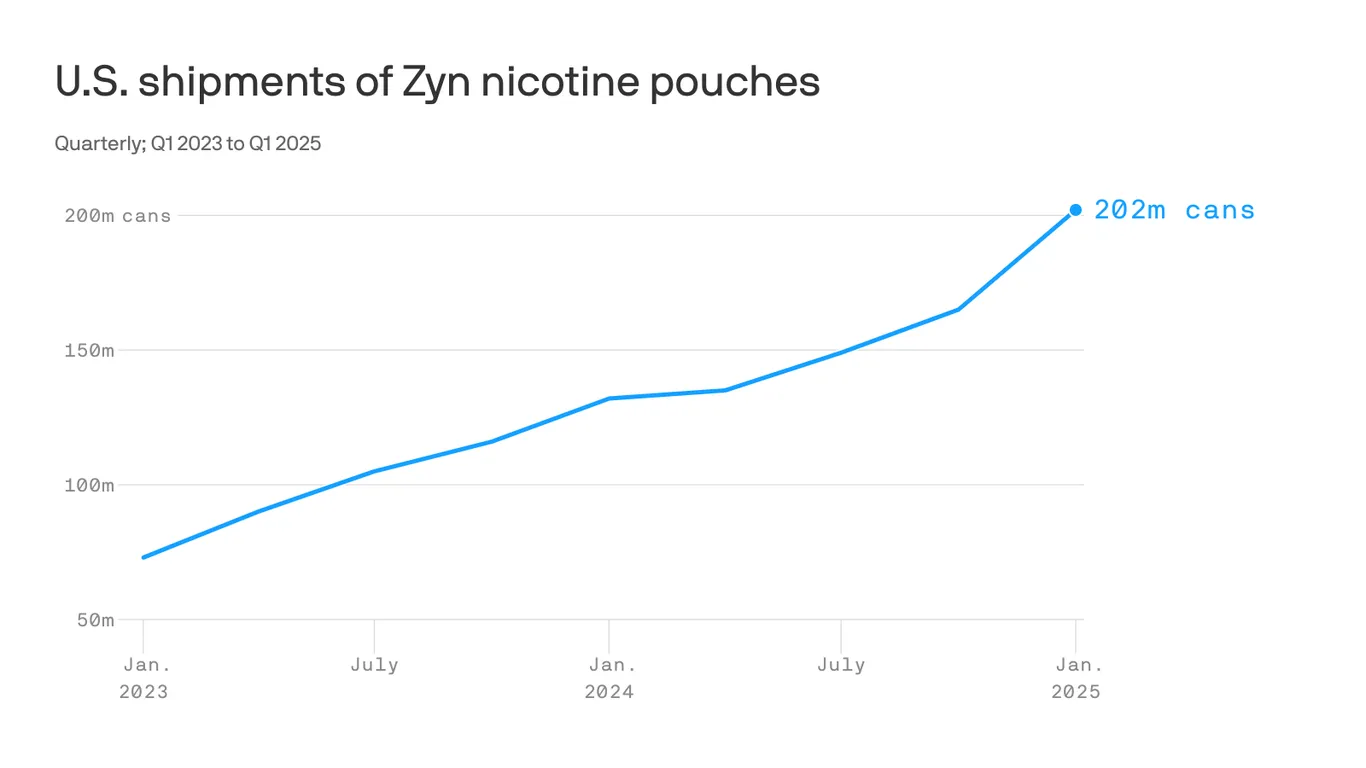

Rising Use of Zyn Nicotine Pouches Sparks Health Concerns

Sales of Zyn nicotine pouches are rapidly increasing in the U.S., driven by their discreet, smoke-free design and potential as a safer alternative to smoking, though concerns about youth appeal and addiction persist. The FDA has recently approved marketing for some Zyn products, and the company is expanding production, raising questions about regulation and public health impacts.