"Johnson & Johnson's $13.1 Billion Acquisition of Shockwave Medical"

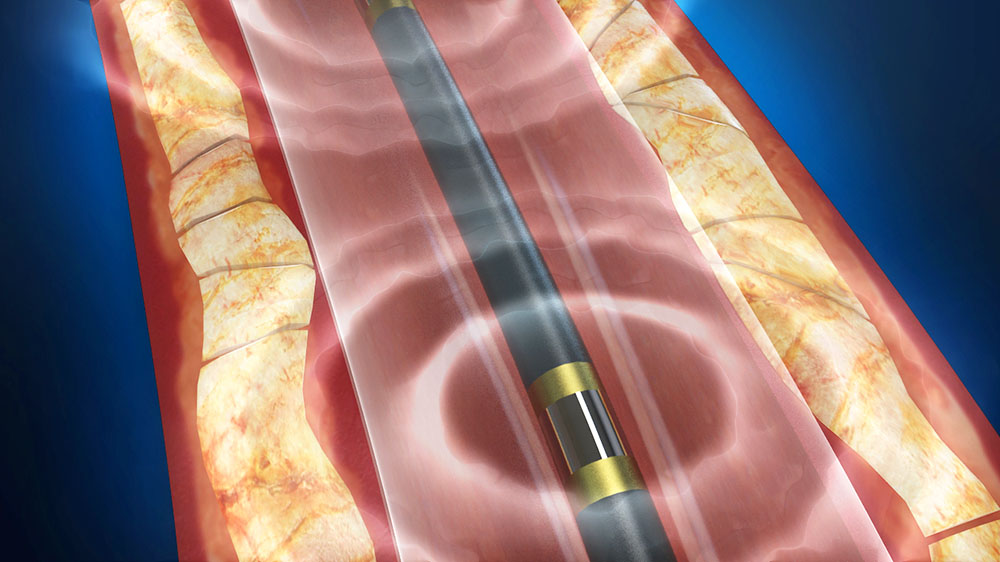

Johnson & Johnson has agreed to acquire Shockwave Medical for $13.1 billion, expanding its cardiovascular portfolio into coronary artery disease and peripheral artery disease segments. The deal, expected to close in mid-2024, will be funded through cash on hand and debt. Shockwave's intravascular lithotripsy devices complement J&J's existing heart pumps, and the company plans to invest in growth within the under-penetrated segments. Despite potential regulatory challenges, J&J CEO Joaquin Duato expressed confidence in the deal's timing, while analysts believe the $13.1 billion agreement represents fair value for Shockwave.