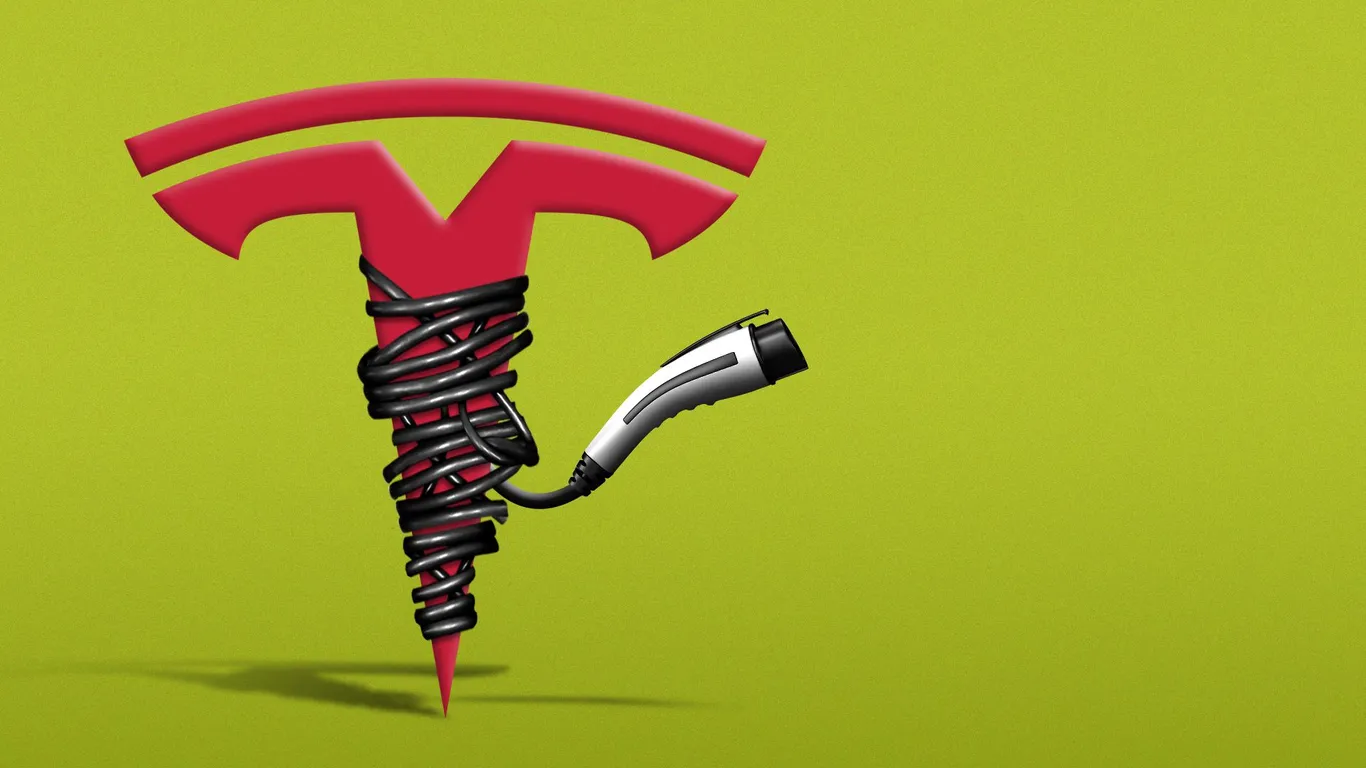

Tesla's Earnings Drop Despite Record Revenue and Future Robotaxi Plans

Tesla's recent financial disclosures reveal that Elon Musk's lobbying efforts against EV-friendly regulations have resulted in a $1.4 billion loss in revenue due to reduced regulatory credits, and his political activities have also damaged Tesla's brand and sales globally. Despite this, Musk plans to extract up to $1 trillion from Tesla shareholders through stock grants, further risking the company's future.