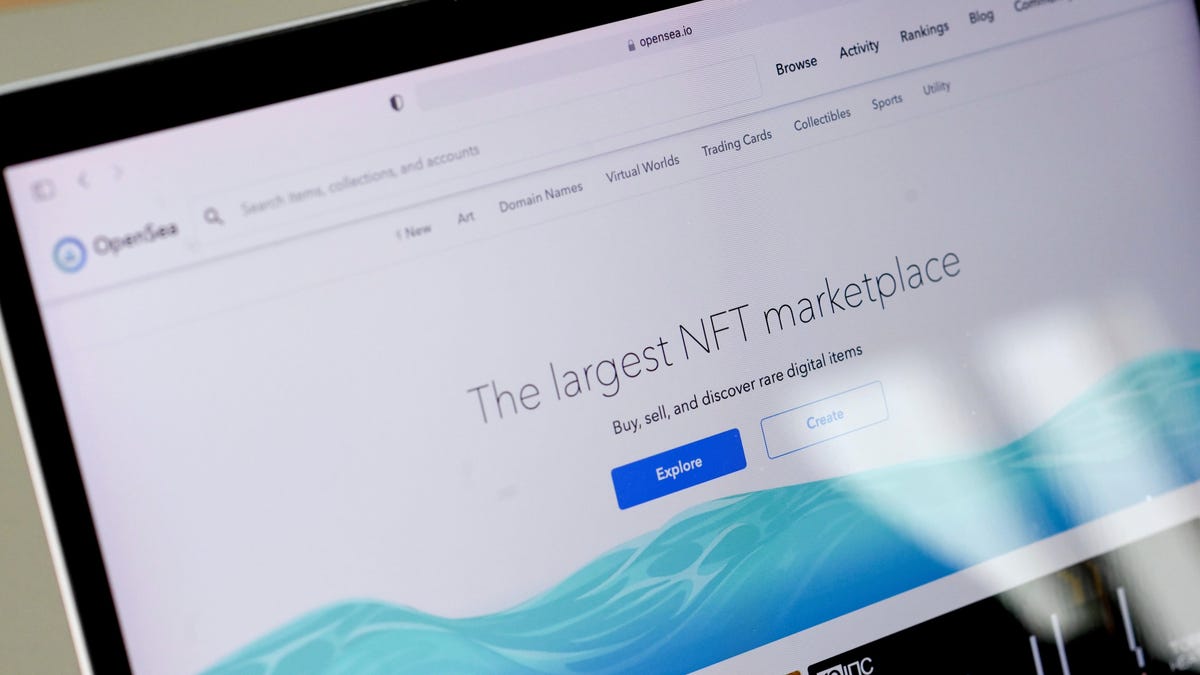

OpenSea Investor Takes Massive 90% Hit on Platform Stake: Report

Coatue Management, a major investor in OpenSea, has marked down its investment in the nonfungible token (NFT) platform by 90%, reducing its stake from $120 million to $13 million. This implies that OpenSea's valuation has fallen to $1.4 billion. Coatue also marked down its investment in Web3 payment provider MoonPay by the same percentage. The markdown comes amid a slump in NFT trading volumes, with OpenSea recently announcing a 50% reduction in staff as part of its plan to relaunch as OpenSea 2.0. The platform's CEO stated that the focus will be on upgrading technology and increasing speed and quality.