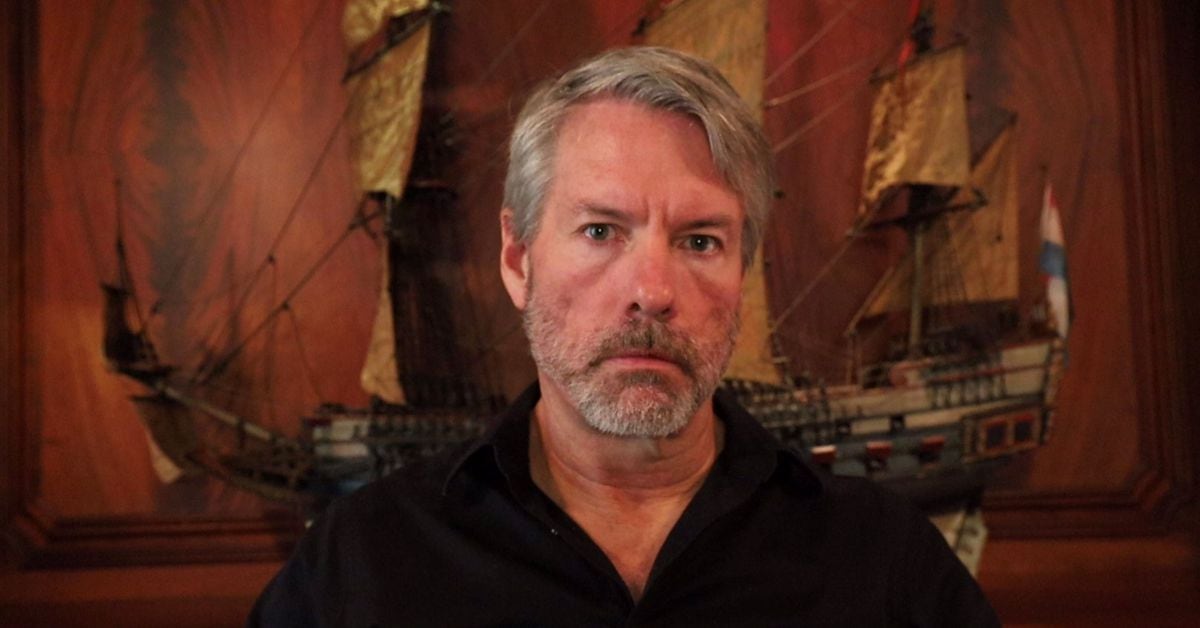

Bitcoin Swings Create Potential Buy Window for MicroStrategy (MSTR)

TipRanks highlights a top investor sees a possible buy window for MicroStrategy (MSTR) as Bitcoin remains volatile. The Q4 2025 results show a large on‑paper loss from fair‑value accounting of its bitcoin holdings, but management’s indefinite bitcoin horizon means most losses are unrealized. MSTR trades near its bitcoin value (mNAV ~1.08) and has historically outperformed BTC when bought at or below that level, suggesting upside if BTC falls further. The investor maintains a Hold stance for now; analysts are broadly bullish with a Strong Buy consensus and a 12‑month target of $361.73 (about 168% upside). If BTC bears persist and mNAV drops below 1, the investor would upgrade to Buy.