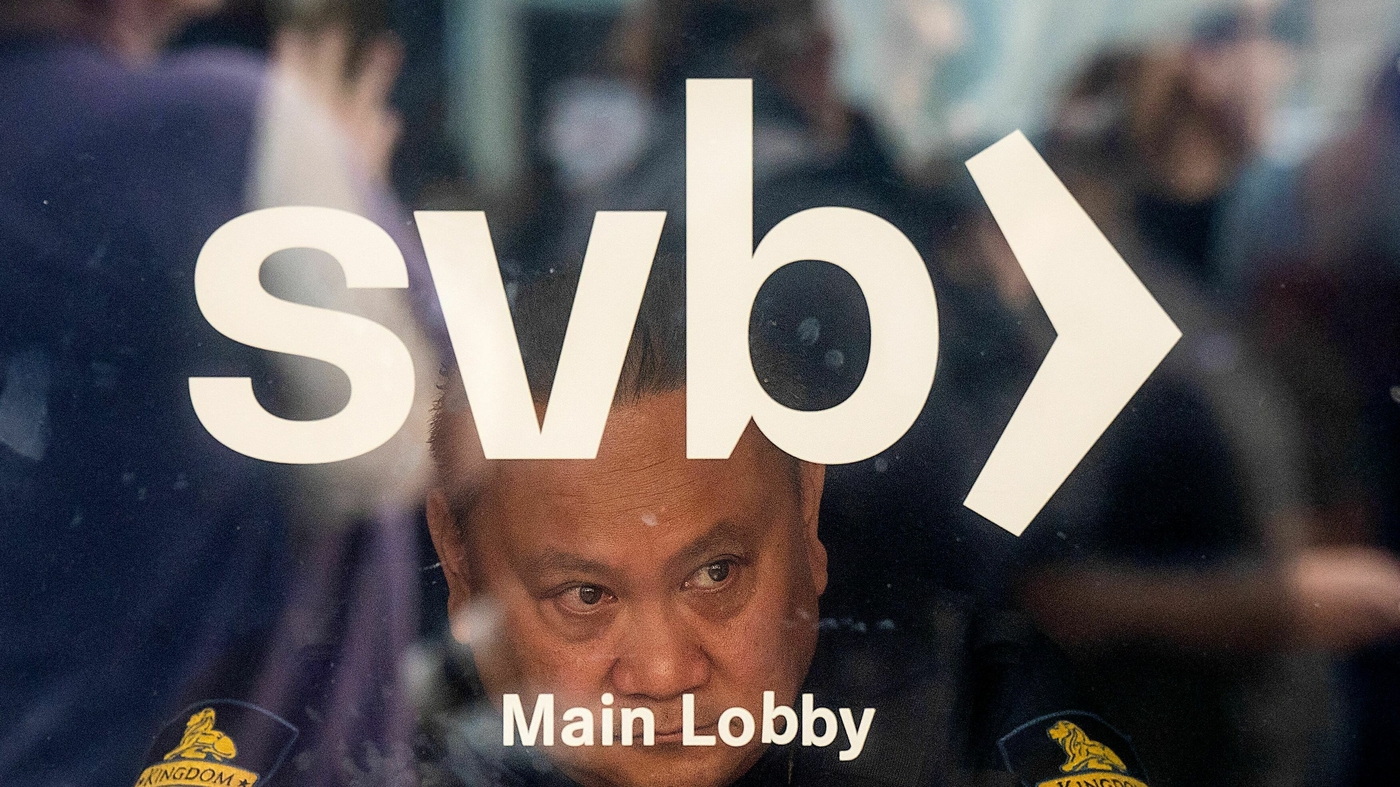

Minority Leaders Concerned Over SVB Collapse and Demonstrating Their Influence

The collapse of Silicon Valley Bank (SVB) has raised concerns among depositors of minority-owned banks, who are turning to community banks for financial support. Small banks lost at least $108 billion in the week following the collapse of SVB, which could have ripple effects on minority-owned banks that often work with people of color who are unable to get funding from America's largest banks. Leaders of these smaller institutions are urging the government to step in and provide solutions, including reinstating full deposit insurance coverage for depositors and restarting the program to remove treasury deposits from large banks and into minority depository institutions.